The ‘2030 Youngkul tribe’ is standing on the edge of a cliff. As the real estate market showed signs of turning into a downtrend, the younger generation, who were surprised by the sharp rise in real estate prices, began to ponder whether to sell their house. The 2030 coin and stock ants are already continuing their ‘adorable march’. Experts diagnose that ‘Fear Of Missing Out syndrome’, which does not want to fall behind others in their 20s and 30s, is behind such investment failures.

View larger image

○In less than a year since I bought it, ‘sudden sales of tears’

Kim (32), who bought 41.2 square meters of exclusive area for the 8th round of Jugong in Top Village, Bundang-gu, Seongnam, Gyeonggi Province last October for 720 million won. At the time, he borrowed 240 million won to buy a house. Kim, who received a mortgage loan at an interest rate of the late 3% range, had to pay regarding 1 million won in repayment of principal and interest. Then I received a notice of a recent interest rate hike. The amount to be repaid each month from next month jumped to 1.5 million won.

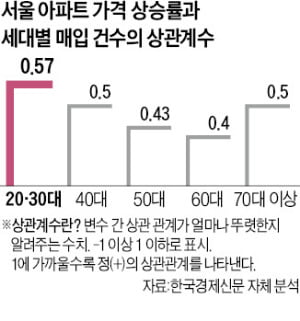

Kim is contemplating whether to sell the apartment once more. Kim’s monthly salary is 250,000 won. If he pays off the principal and interest of the loan, he can only spend 1 million won on his living expenses. The bigger problem is that the same counterweight is currently listed for 700 million won. “I’m only thinking regarding the timing of stop loss,” said Kim. According to Jikbang, the percentage of people who bought a house less than a year ago selling it is also rising sharply. Among all sellers, the proportion of owners with less than one year rose from 7.16% in the third quarter of last year to 9.92% in the second quarter of this year. According to the Korea Real Estate Agency, the proportion of people in their 20s and 30s in real estate purchases since July last year reached 41%. Jang Jae-hyeon, head of Real Today’s research division, said, “The younger generation lacks the strength to endure because their income is low.”

○ Stock and coin ants are already ‘a march of hardship’

Those in their 20s and 30s who invested in stocks and coins are already in a state of panic. Ms. Jeong (28), an office worker who invested in Luna Coin. He started investing in coins in early 2020, and when he made millions of won a day, he boldly took out loans from acquaintances and banks. His assets increased to regarding 150 million won, and he seemed to be on the road to success. However, due to the Terra-Luna incident, Jung’s assets plummeted to the level of 10 million won. Jung said, “I thought that a bold investment was necessary to buy real estate because my monthly salary was less than 3 million won. “He said. He plans to apply for his personal rehabilitation if his last investment also fails.

In the second half of 2020, Lee (38), who attends a public finance company, invested regarding 40 million won in stocks, including emergency funds and loans. Once, following earning a valuation of more than 10 million won, he changed his golf club and bought a newer smartphone. He signed a contract for a semi-large sedan earlier this year. However, since the beginning of this year, stocks have plummeted, resulting in a loss of 15 million won. He also canceled the contract for a new car he ordered.

○ 2030 investment failure ‘Fomo Syndrome’

Experts point out that “the tendency for people in their 20s and 30s to invest with a strong impulse caused by ‘Fomo Syndrome’ is excessive”. Fomo syndrome refers to a kind of fear of isolation, feeling that only oneself is excluded from the flow of the world. The 2030 generation is a generation that has embodied competition by competing for entrance exams when private education has become common since the 1990s. I have been using SNS since I was a teenager. As a result, it is analyzed that he is seriously suffering from Fomo syndrome, who is sensitive to comparison and not to be left behind.

Kwak Geum-joo, a psychology professor at Seoul National University, said, “When it comes to people in their 20s and 30s who are sensitive to comparisons with others, who made money with coins or were enchanted by real estate, there must have been a psychology of ‘Should I go in too? case,” he said.

There is also an analysis that the nervousness felt by the surge in real estate prices has led to extreme investments in the stock and coin markets. Choi Hwang-su, a professor of real estate at Konkuk University, said, “In the past, young people had hope that they might buy a house someday even if they didn’t have a house right away. There is a tendency to make this ‘don’t ask’ investment,” he said.

By Min-ki Koo/Kwang-sik Lee/ Se-young Choi, staff reporter [email protected]