The wave of China’s debt suspension has caused the share price of Bank of China to fluctuate. China Merchants Bank’s A shares fell by more than 6% on the 14th.Figure: Retrieved from Wikipedia

Recently, there has been a turmoil in China’s real estate industry. Many “unfinished buildings” cannot resume work due to lack of funds. It is reported that the owners will collectively stop paying mortgages, causing an earthquake in the banking industry. At 2 to 3 trillion yuan (regarding 9 to 13 trillion Taiwan dollars), CCP officials are waiting for Chinese President Xi Jinping to quickly decide on a policy “demining”.

According to Qin Peng, the host of the “Current Affairs Daily Chat” program, China’s A-shares and Hong Kong-listed Bank of China have fallen sharply due to the proprietors’ notice that they will suspend debt collectively. China Merchants Bank’s A-shares once fell by more than 6%. The banks had to come out to appease the hearts of the people. A China Construction Bank stated that it adheres to the principle of “housing and not speculating”, adheres to a prudent and steady risk appetite, and firmly implements the housing leasing strategy to promote a virtuous circle and healthy development of the real estate industry. Several bankers described the situation as “manageable.”

One of the reasons for people’s resentment is that people buy houses and transfer their money to the “supervisory fund account”, but the government and supervision banks have colluded with real estate developers, and people’s hard-earned money is lost. Officials can only say that the money “should” remain in the account.

To make matters worse, China’s real estate market is facing a cold winter. The average sales of the TOP100 real estate companies was 35.64 billion yuan, down 48.6% year-on-year. According to data released by the Kerui Real Estate Research Center, the sales amount of the top 100 real estate companies from January to June fell by 51% year-on-year, equivalent to half. It shows that the flow of funds for real estate developers will be more difficult, and the situation of work stoppages will be more serious.

China has recently erupted in disputes over unfinished properties.Figure: Retrieved from Weibo

Qin Peng said that according to the “Everbright Bank Exchange Records”, the funding gap is between 2 and 3 trillion, and the incident has spread faster than expected. It is necessary for the top leaders of the CCP to quickly decide on a response plan to alleviate this phenomenon.

Qin Peng raised two questions: First, the real estate developers did not have funds, so the builders did not dare to resume work, and the unfinished buildings might not be completed; second, the unfinished buildings in the past were basically isolated phenomena, but now they are happening in large numbers. Many of the tail buildings are projects of famous national real estate companies such as Evergrande, Shimao, and Sunac.

Qin Peng said that some local governments have proposed solutions, hoping that the central government will provide the total funding to turn the unfinished buildings up first, so that buyers can have confidence in handing over the houses. In the past, a few state-owned enterprises have acquired a small number of high-quality projects.

Qin Peng finally mentioned that the most important thing at the moment is how to understand Xi Jinping’s “no housing speculation” policy. Officials worry that if they use raising funds to save the market, even if they can make local governments and property owners happy, they may violate Xi’s “wise instructions” , the outside world is looking forward to how Xi Jinping will respond next.

There has been a turmoil in China’s real estate recently, and many “unfinished buildings” cannot resume work due to lack of funds

Owners reported to collectively stop paying mortgages, causing an earthquake in the banking industry

The media predicts that the funding gap is 2-3 trillion, and CCP officials are waiting for President Xi Jinping to quickly decide on the policy of “demining”.

Recently, the owners of many unfinished buildings in China said that they collectively stopped repaying their loans, which hit the mainland banking system. (Schematic) Photo: Dazhi Image/Archyde.com

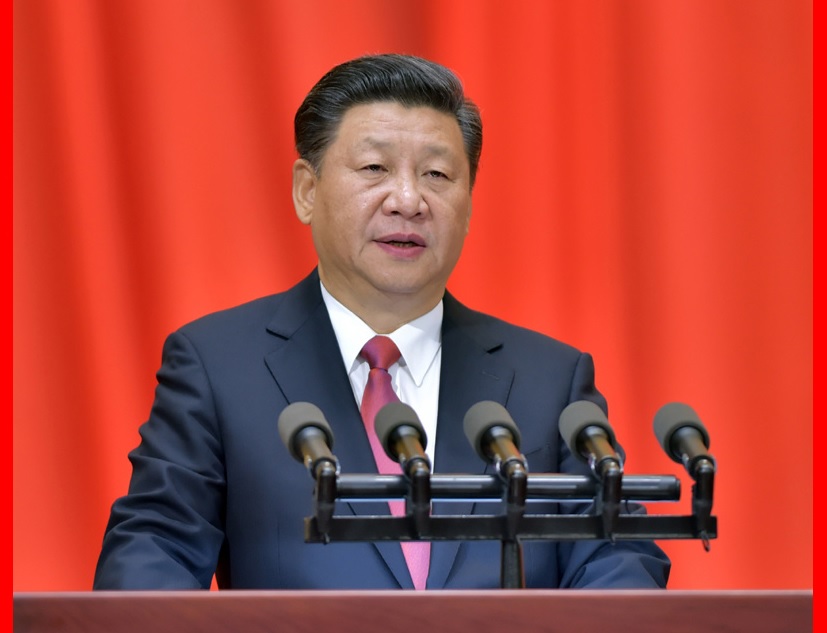

Chinese President Xi Jinping. Figure: Retrieved from CCTV (file photo)

There has been a wave of loan suspensions in many places in China recently, and the owners of unfinished buildings collectively stopped repaying their loans until the project restarted.Figure: Taken from Weibo