Would you like to taste Korean spicy food? Nongshim and Samyang, Shin Ramyun and Buldak Stir-fried Noodles Original

(Photo courtesy of Nongshim)

As Vietnam overtook Korea to become the world’s largest ramyun consumption per capita, K-ramyun companies have been busy. Domestic ramen makers, who were quick to enter Vietnam, have been working hard on localization by setting up local production facilities and launching low-priced products to suit local circumstances where pockets are light, or by introducing small-capacity products. However, due to the recent rise in popularity of Hallyu such as K-pop and K-movie, they are selling domestic products as they are, emphasizing that they are Korean products.

According to the World Instant Noodles Association (WINA) on the 3rd, Vietnam’s annual per capita consumption of 87 instant noodles last year ranked first. Korea ranks second with 73 per year, and Nepal ranks third with 55. Korea ranked first in the world for per capita ramen consumption by 2020, but lost the lead to Vietnam, which has increased purchasing power due to high economic growth rates.

In terms of the size of the ramen market, which also reflects the population, Vietnam maintained the fifth place with annual consumption of 5.4 billion until 2019, and then rose to 7 billion in 2020, occupying the third place. Last year, the number grew to 8.6 billion. China (44 billion) and Indonesia (13.3 billion) took the first and second places globally. Korea rose to 4.1 billion in 2020 in the followingmath of Corona 19, but fell to 3.8 billion last year due to the growth of HMR, placing it in 8th place.

About 50 local companies, including Vina Acecook, Masan, and Asia Food, occupy regarding 70% of the Vietnamese ramen market, and 30% are foreign companies. Among overseas brands, K-ramyeon accounts for regarding 55% of the total, and China ranks second with regarding 20%. Thailand (13%) and Japan (9%) follow, followed by Singapore, Taiwan and Malaysia with less than 1%.

▲ OTTOGI Vietnam’s Bac Ninh Factory (Photo courtesy: OTTOGI)

As Vietnam became ‘hot’, domestic ramen makers have been promoting localization, such as small-volume products. This is because Korean ramen is around 120-140g, while local ramen is 80g, and unlike local products that cost 300-400 won, domestic products are classified as expensive products, exceeding 1,000 won. An official from a ramen company explained, “It is said that Vietnam’s purchasing power has improved, but the starting salary for a college graduate is around $400, so purchasing ramen in Korea is still a burdensome price.”

Ottogi is considered as a representative K-ramyun company targeting the local market with a two-track strategy such as original and localization, such as domestically manufactured ramen, locally produced products (120g) and mini-small-size products (80g). The company established a Vietnamese subsidiary in 2006 and started business mainly with sauces, then in June 2018, it entered the Vietnamese market in earnest by setting up a Ramen factory in Bac Ninh near Hanoi. Bac Ninh Factory is Ottogi’s only overseas ramen production facility.

(Photo courtesy of Ottogi)

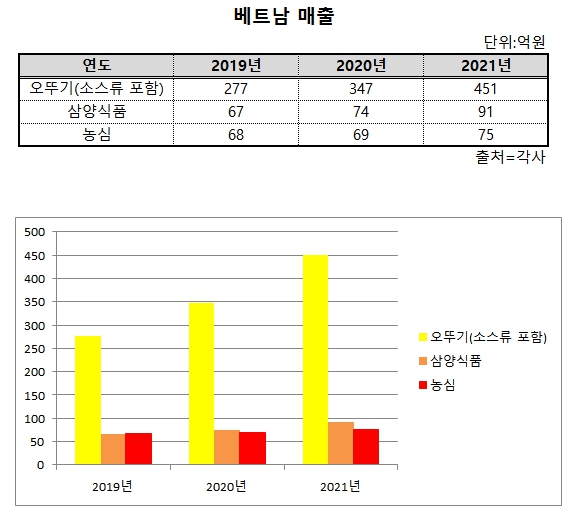

Performance is good. Sales of the Vietnamese subsidiary from 27.7 billion won in 2019 increased 25.3% to 34.7 billion won the following year, and 45.1 billion won last year, up 23.1% from the previous year. However, this includes sales of sauce along with ramen. Net profit in 2019 jumped from 400 million won to 1.1 billion won the following year, and rose to 1.6 billion won last year. Recently, in order to target teenagers and 20s who have emerged as a major consumer group, we are also holding events for customers who purchase jajang ramen sold in Vietnam, such as real jangjang and Beijing jjajang.

Paldo established a corporation in Vietnam in 2006 and built a 12,000 square meter factory in Phu Tho Province, northern province, in 2012, giving strength to the local market. In line with the price of local ramen, they have created a brand called ‘Koreno’ and are introducing various products such as Jajangmyeon and Rabokki.

Companies that have recently entered the market in earnest are emphasizing that it is K-ramyeon with the same spiciness and capacity as domestic ramen in line with the Hallyu craze. Nongshim established a Vietnamese subsidiary in 2018 and is marketing major brands such as Shin Ramyun, Chapagetti, and Raccoon. Growth is steep. Sales of the Vietnamese subsidiary increased from 6.8 billion won in 2019 to 7.5 billion won last year.

Nongshim is installing ramen cooking machines in some convenience stores, which are the main consumption channels of the young generation in Vietnam, and operates a Shin Ramyun food truck in Ho Chi Minh City. In addition, marketing has been strengthened through sampling events at large discount stores. Recently, due to the popularity of the movie Parasite, they are focusing on promoting K Ramen by introducing Shin Ramyun Fried Noodles and Kaguri, etc.

(Photo courtesy of Nongshim)

A Nongshim official said, “Due to the popularity of Korean ramyun, local manufacturers such as Ace Cook are releasing Korean-style high-weight and high-quality products, and Korean-style ramyun is becoming a trend. We plan to continue exporting our products as they are,” he said.

In 2018, Samyang Foods started selling ramen in partnership with Saigon Coop, a Vietnamese retailer. The main products are the original Buldak-bokkeummyeon, Jjajjaroni, Cheese Buldak-bokkeummyeon, Carbo Buldak-bokkeum-myeon, and Buldak-bokkeumtangmyeon. Recently, he participated in the 33rd anniversary of Kum Mart in Vietnam.

Samyang Foods’ Vietnam emissions are growing from 6.7 billion won in 2019 to 7.4 billion won in 2020 and 9.1 billion won in 2021. A company official explained, “We are selling products with the same spicy taste and capacity in Vietnam.”