According to Forbes, during trading on June 12, the Ethereum cryptocurrency exchange rate fell to a minimum recorded more than a year ago. At the same time, the price of the crypto asset continues to fall, and one of the reasons the publication names the highest inflation in the United States in more than 40 years.

Image Source: DrawKit Illustrations/unsplash.com

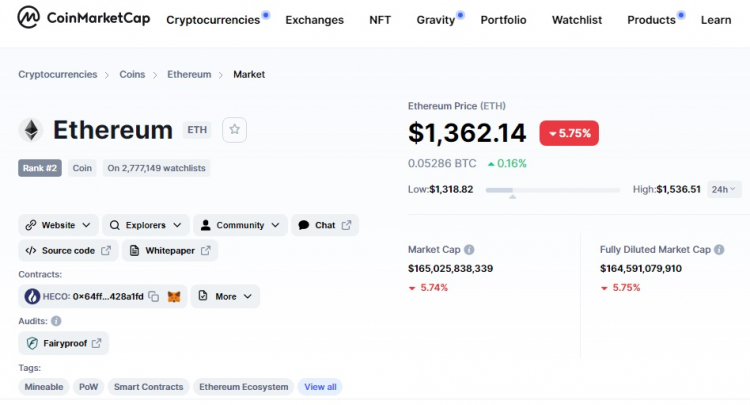

According to Forbes, referring to the Coinmarketcap exchange, “Over the past 24 hours, Ethereum prices have dropped to $1,436.18”. By 14:20 Moscow time, the cryptocurrency fell to $1,460 — 7.8% cheaper than the day before. According to the latest data from the same exchange at the moment, the situation is even worse – the Ethereum rate has dipped to $1362.14.

The capitalization of Ethereum was regarding $176.8 billion. Bitcoin, the largest cryptocurrency by capitalization, also fell in price to $27,266 on June 12, and by 14:20 ISS one coin was worth $27,394, 5% less than the day before. According to current data, the fall continues – bitcoin is already worth $25,724. The same happened with smaller, but well-known cryptocurrencies – Dogecoin and Shiba Inu, yesterday they fell in price by more than 10%.

According to Forbes, citing Bloomberg, the cryptocurrency market has suffered due to new data on inflation in the United States, which turned out to be much higher than expected. The U.S. Federal Bureau of Labor Statistics said the CPI was up 8.6% last month from last May, its worst reading in 40 years since 1981. According to available data, the so-called. “Core inflation” excluding the cost of food and energy increased by 6% – the overall rise in prices was influenced by the rise in the cost of housing, fuel and food.

Image Source: Coinmarketcap

According to experts, the tightening of policies regarding the relevant assets by the central banks of many countries negatively affects the cryptocurrency market. It is predicted that the fall in rates will continue at least this week. According to some industry experts, “In the past, in a similar state of the market, bitcoin has fallen in price by regarding 80%, and alternative cryptocurrencies by 90%.

According to Forbes, regarding 30% of the richest people on the planet directly or indirectly invest in crypto assets. At the same time, the share of investors in “crypto” among them is higher than among those who are not billionaires. It is known that almost 20% of the 65 dollar billionaires surveyed hold at least 1% of their fortune in cryptocurrencies, and 80% of the billionaires who invested in cryptocurrency spent at least 10% of their fortune on it.

Earlier it was reported that the developers of the Ethereum network postponed the launch so-called “Difficulty bombs” – a special algorithm designed to gradually turn off the miners.

If you notice an error, select it with the mouse and press CTRL + ENTER.