Is the house in Seoul the only home? All interest in the real estate market is focused on Seoul. Even outside of Seoul, there are not one or two markets to keep an eye on. ‘Paldo Real Estate’ looks at the real estate market flow from Gyeonggi-Incheon to the local real estate market and examines various issues.[편집자]

‘Nationwide house price increase rate 1st’ (2020) → ‘Nationwide house price decrease rate 1st place’ (2022)

The mood of the market was turned upside down in an instant. Investors from all over the country flocked to the market due to various good news, and the market, which burned rapidly, has not been able to escape from the cold wave for nearly a year. This is the story of Sejong City, which has already entered a decline in house prices for 46 weeks.

In Sejong City, house prices have begun to fall due to interest rate hikes and strengthened loans since the second half of last year, and housing demand, infrastructure, and transportation shortages act as limitations, making it difficult to reverse the mood.

However, there is also the prospect of seeing the light little by little. There is a possibility that the favorable news of the second office of the president will be reflected additionally, and the fact that the number of occupants has been weakened is also analyzed as a positive factor. Will there ever come a day when the house price roller coaster in Sejong will soar once more?

The key keywords in Sejong City are #Crash #JeonseRate #Sejong Office

Beep-It’s a Plunge (feat. No. 1 house price drop rate)

House prices in Sejong City are on a negative streak.

According to the weekly apartment price trend of the Korea Real Estate Agency, apartment sales prices in Sejong City fell 0.10% from the previous week in the first week of June (as of the 6th). Although the drop was smaller than the previous week’s sales price fluctuation rate (-0.13%), weekly apartment prices in Sejong have been declining for 46 consecutive weeks since the fourth week of July last year (July 26).

The Real Estate Agency analyzed, “The downtrend continues as the backlog of properties and the contraction of trading sentiment continue.” In fact, according to real estate big data company Asil, there were 5,209 apartments for sale in Sejong as of the 9th. It increased by 30.9% from the end of July last year (3979 cases as of 31st) when the downward trend began.

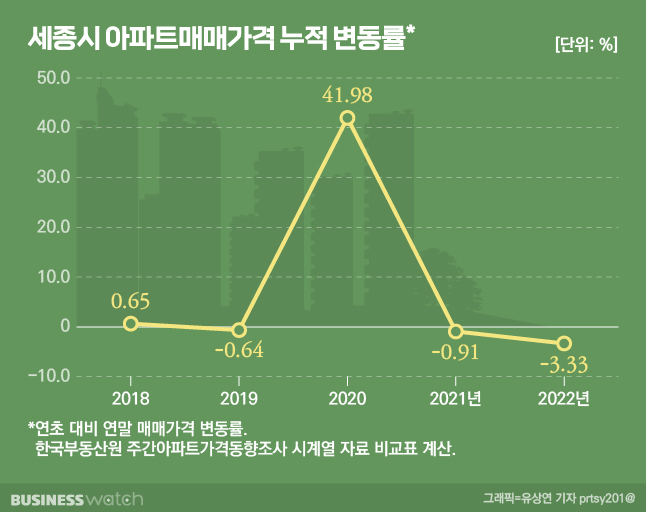

According to the Real Estate Agency, from the beginning of the year (January 3) to the first week of June, the cumulative change rate of apartment sales prices in Sejong City was -3.42%, the largest drop in the country. The Sejong real estate market has changed completely for the first time in over a year.

Sejong apartment prices recorded the highest annual house price increase in the country (41.98%, statistics from the Real Estate Agency) in 2020 as the ‘theory of relocation of capital and government agencies’ was raised. In the real estate market at that time, the investment enthusiasm for Sejong was so hot that even a new word was coined, ‘Seo Se-won’ (meaning that there should be one house in Seoul and one house in Sejong).

It was in the second half of last year that the atmosphere began to reverse.

As house prices soared in a short period of time, fatigue from rising house prices was accumulating. With the change of government, expectations for capital relocation and development policies gradually cooled.

Recently, there are also places where the price has dropped by hundreds of millions of won. According to the apartment transaction price inquiry system of the Ministry of Land, Infrastructure and Transport, the 84 m² dedicated to Saesam Village 9 complex in Sodam-dong, Sejong City was traded for 755 million won (5th floor) on the 1st, compared to 1.03 billion won (19th floor) in March last year, the previous reported price. 275 million was lost. The Sharp Hill State (Saeteum Village 11 Complex)-only 98m2 was also traded at 1.1 billion won (13th floor) on the 20th of last month, 200 million won lower than the previous transaction price (1.3 billion won in March).

Last in Jeonse Ratio (feat. Not enough demand)

The market is predicting that Sejong house prices will continue to decline for some time. This is because demand cannot support supply.

According to Asil, the average annual number of apartments in Sejong City is 1,896 households. However, in Sejong City, a total of 47,754 households moved in over the past five years, including 14,769 households in 2017, 12,922 households in 2018, 8738 households in 2019, 4287 households in 2020, and 7668 households in 2021. The number of households in Sejong City in 2020 surveyed by the National Statistical Office was 141,133, which is equivalent to supplying one-third of the total number of households in five years.

While supply is plentiful, demand is lacking. The Jeonse ratio (the ratio of the Jeonse price to the housing sale price) has plummeted as more people buy houses for investment purposes rather than directly living there.

According to the Korea Appraisal Board, the average nationwide apartment jeonse rate as of April was 68.8%. However, the Jeonse rate in Sejong is 47.7%, far below the average, the lowest in the country. Compared to June last year (60.4%), just before entering the downward trend, this is a drop of 12.7 percentage points.

Moreover, as the special supply system for public officials’ apartments in Sejong City was abolished from May of last year, the incentives for civil servants to relocate disappeared.

In such a situation, the market’s forecast that Sejong City’s house price adjustment will continue for a while and the ‘bubble’ will fall, prevails.

Sejong Mayor-elect Choi Min-ho also mentioned the real estate problem at a press conference on the 7th and said, “I honestly think it is expensive when it comes to whether house prices are cheap or expensive.”

Sejong Office, Will the Second Yongsan Effect?

However, there are still strong prospects for development.

Previously, the city of Sejong proposed to President Yoon Seok-yeol a plan to build a new Sejong office in time for the opening of the Sejong Shrine of the National Assembly in 2027. On the 29th of last month, a partial amendment bill to the ‘Special Act for the Construction of a Multifunctional Administrative City in Yeongi-Gongju Region for Follow-up Measures of the New Administrative Capital’ was passed by the National Assembly.

Regarding the installation of the office and Sejong Shrine, it was already reflected in the house price in 2020, but as the legal foundation for the president to see state affairs in Sejong is clearly established, there is an expectation that the price will have an effect as the perception of good news is strong once more.

In fact, following the issue of installing the presidential office in Yongsan-gu, Seoul, the price has been steadily rising. According to KB Kookmin Bank’s monthly time series data on housing price trends, the average apartment price per 3.3 square meters (1 pyeong) in Yongsan-gu last month was 60.16 million won, up 870,000 won from the previous month (59.29 million won), exceeding 60 million won for the first time.

Population growth is also promising. According to the National Statistical Office, the number of net inflows to Sejong City decreased to 34,690 in 2017, 31,433 in 2018, 23,724 in 2019, and 13,025 in 2020, before returning to recovery to 14,085 in 2021. . The supply of apartments is also taking a breather. According to Asil, 2284 households this year and 1,782 households next year are expected to move in.

Ham Young-jin, head of Big Data Lab, said, “Sejong City has a lot of tenants so far, so prices are being adjusted due to the followingeffects, but it is also a central city for administration, and there are good things such as the President’s Office, the Sejong City Hall, and the Seoul-Sejong Expressway. This is fine,” he said. However, he predicted that “it seems difficult to seize momentum for a price rebound within this year due to the small population, the need for an influx of demand, and fatigue from interest rate hikes and price increases,” he said.