On the 3rd (local time), the major indices of the New York Stock Exchange fell all at once. The bad news has been pouring in right before the opening. Last month’s employment figures were released and beat market expectations. A stable job market has been confirmed once once more, lowering the chances of an easing by the US central bank (Fed).

Tesla CEO Elon Musk said in an email to employees that he had a “feeling that the economy was going to be super bad” and that he would cut 10% of its global workforce. The news that even the world’s largest electric car, which has been a relative beneficiary of high gasoline prices, is going to cut jobs shocked the market.

Elon Musk, Tesla CEO. Archyde.com Yonhap News

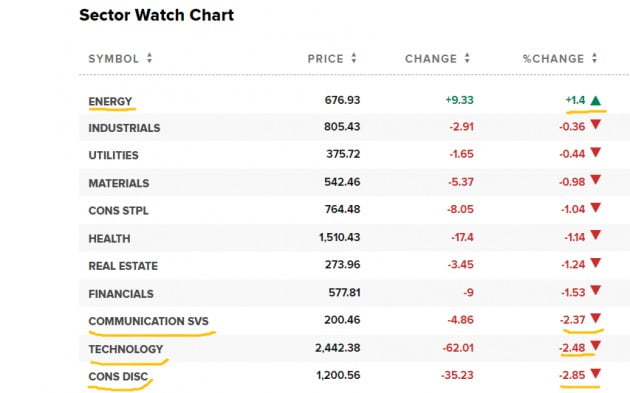

The leading index, the S&P 500, fell 1.63% to 4,108.54, the Nasdaq plunged 2.47% to 12,012.73, and the Dow plunged 1.05% to 32,899.70, respectively. It closed higher last week, but turned downward once more on a weekly basis.

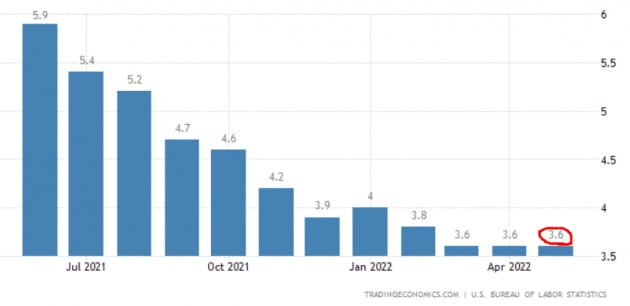

A May report from the US Department of Labor confirmed that “the job market remains strong.”

The number of non-farm jobs in May increased by 390,000 from the previous month. It exceeded the average of analysts polled by the Wall Street Journal (an increase of 328,000). The figure for April was revised up to an increase of 436,000 from 428,000.

The unemployment rate stood at 3.6%, the same level for the third straight month. This level of unemployment is close to the record low in February 2020 (3.5%).

The U.S. unemployment rate stood at 3.6% last month, the lowest level for the third straight month. Courtesy of the U.S. Department of Labor and Trading Economics

Average hourly wages increased 0.3% from the previous month and 5.24% from the previous year. But because inflation is so high, real wages have been negative for over a year.

“The recent bull market has been a typical bear market rally,” said Michael Hartnett, chief strategist at Bank of America. In particular, it is expected that the hawkish (preferring monetary tightening) Fed’s attitude will shift to a little dove (preferring monetary easing) attitude this year only when the number of jobs turns downward.

Don Fitzpatrick, chief investment officer (CIO) of Soros Fund Asset Management, said, “In conclusion, a recession in the United States is inevitable.” However, even if a recession comes, I thought it would come much later than people think now.

Cleveland Federal Bank Governor Loretta Mester, who will attend the Fed’s Federal Open Market Committee (FOMC) this year, emphasized ‘stronger austerity’ in an interview with CNBC.

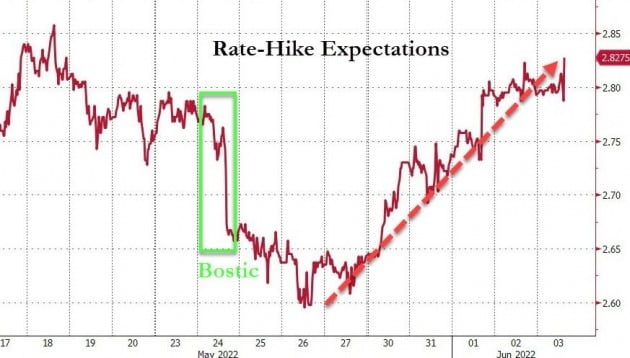

Atlanta Fed President Rafael Bostic said at the end of last month that interest rate hikes might be halted at the September meeting, but interest rate expectations fell, but other central bank (Fed) members continued to raise austerity measures following that. reversed

“Inflation has not yet reached the peak,” Mester said at the September Monetary Policy Meeting, adding that “if inflation shows no signs of slowing, it should be raised by another 50 basis points or at least 25 basis points.” In any case, he has made it clear that he will not stop raising rates. Fed Vice-Chairman Rayle Brainerd spoke on the same level.

U.S. Treasury yields and international oil prices rose once more on the same day.

The 10-year U.S. Treasury yield stood at 2.96% a year, up 4 basis points (0.04 percentage points) from the previous day. The two-year yield rose 1 basis point to 2.66%.

On the New York Mercantile Exchange, the price of West Texas Intermediate (WTI) for July futures ended at $118.87 a barrel, up 2.0 dollars from the previous day. On the London ICE Futures Exchange, the price of North Sea Brent crude rose 2.11 dollars to 119.72 dollars per barrel.

The previous day, the Organization of Petroleum Exporting Countries (OPEC) and ‘OPEC+’, a consultative group of major non-OPEC oil producing countries such as Russia, agreed to increase crude oil production by 648,000 barrels per day from July to August, but the effectiveness was low in the market. The prevailing view is that many oil producing countries will not be able to meet their production quotas anyway. Moreover, Russia is likely to cut further production.

The lifting of the COVID-19 lockdown in China, the world’s largest oil importer, and rising demand for crude oil in the United States are another pressure on oil prices.

In the New York Stock Exchange on the 3rd (local time), the indices of 10 sectors excluding energy out of 11 sectors fell. Courtesy of CNBC

Today’s ‘Global Market Now’ issues are as follows.

① Musk “Bad intuition… 10% cut” ② Master “interest rate should be raised in September” ③ Turkey wholesale price 2.3 times ↑ shock ④ Airline stocks plunge despite good news Why? ⑤ ExxonMobil 8-year high ⑥ “Most coins disappear” ⑦ Next week’s attention on inflation, RBA, ECB interest rates, etc.

More details can be found on Hankyung Global Market YouTube and Hankyung.com broadcasts.

New York = Correspondent Jo Jae-gil [email protected]