Service industry loans 46.4 trillion won ↑, working capital loans 41.9 trillion ↑… all second in history

The Bank of Korea “Reproliferation of Omicron and demand for commercial real estate investment will also have an impact”

[연합뉴스TV 제공]

(Seoul = Yonhap News) Reporter Shin Kyung-kyung = Industrial loans in the first quarter (January to March) were approximately 64 trillions increased.

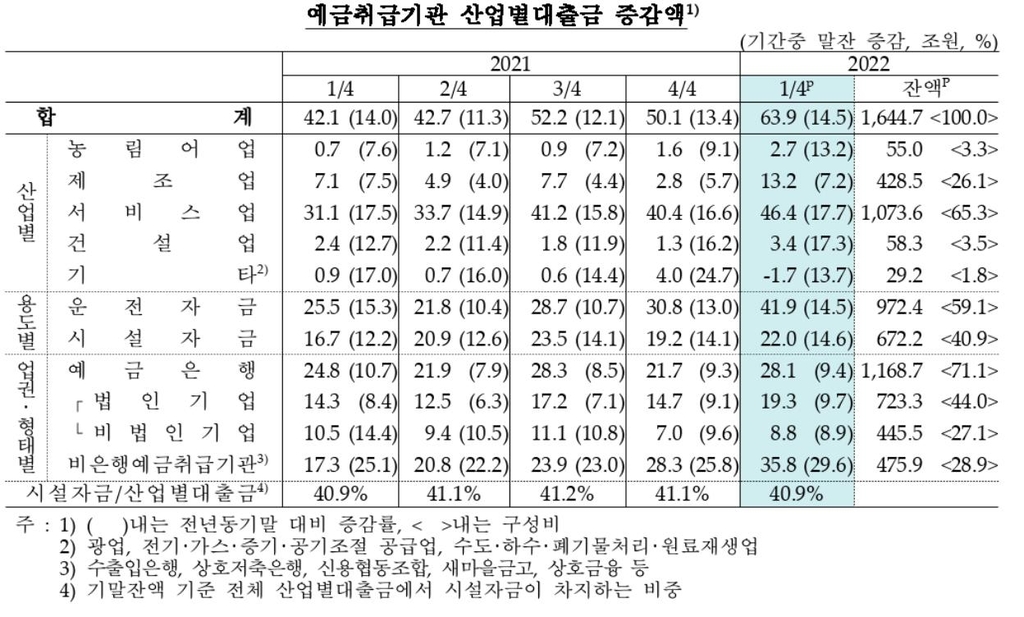

According to statistics released by the Bank of Korea on the 3rd of ‘Loans by Deposit Handling Institutions in the First Quarter of 2022’, as of the end of March, all industrial loans were 164.4 trillion won, up 63.9 trillion won from the fourth quarter of last year.

This increase is the second largest in history following the second quarter of 2020 (69.1 trillion won).

In particular, the balance of loans to the service industry increased by 46.4 trillion won from 127.2 trillion won to 173.6 trillion won, ranking second in terms of increase.

Among the service industries, loans from the real estate business (+13.3 trillion won), which continued investment in commercial real estate, and the wholesale/retail business (+11.8 trillion won), which were affected by the slump in large marts and duty-free shops, increased significantly.

Loans from the accommodation and food industry, which suffered difficulties due to the spread of Omicron, also surged 2.5 trillion won.

The balance of loans to manufacturing increased by 13.2 trillion won from 415.4 trillion won to 428.5 trillion won in three months.

By loan use, facility funds increased by 22 trillion won and working capital by 41.9 trillion won, respectively, in the first quarter. Both are the second largest ever.

Song Jae-chang, head of the Bank of Korea’s financial statistics team, said, “In particular, working capital has increased a lot, and it seems that raw material prices have increased mainly in chemical and medical product-related industries.” “The demand for funds increased, and as the corona financial support continued, loans increased,” he explained.

He said, “The increase in facility funds is due to the demand for investment in commercial real estate that has continued since last year,” he said. added.

Report on Kakao Talk okjebo

<저작권자(c) 연합뉴스,

Unauthorized reproduction-redistribution prohibited>

2022/06/03 12:00 Send