The war in Ukraine is working a miracle for the Colombian economy, while the whole world is worried regarding the increase in the price of oil, among other commodities, Colombia celebrates the revaluation of its currency, which helps mitigate a little the impact on inflation.

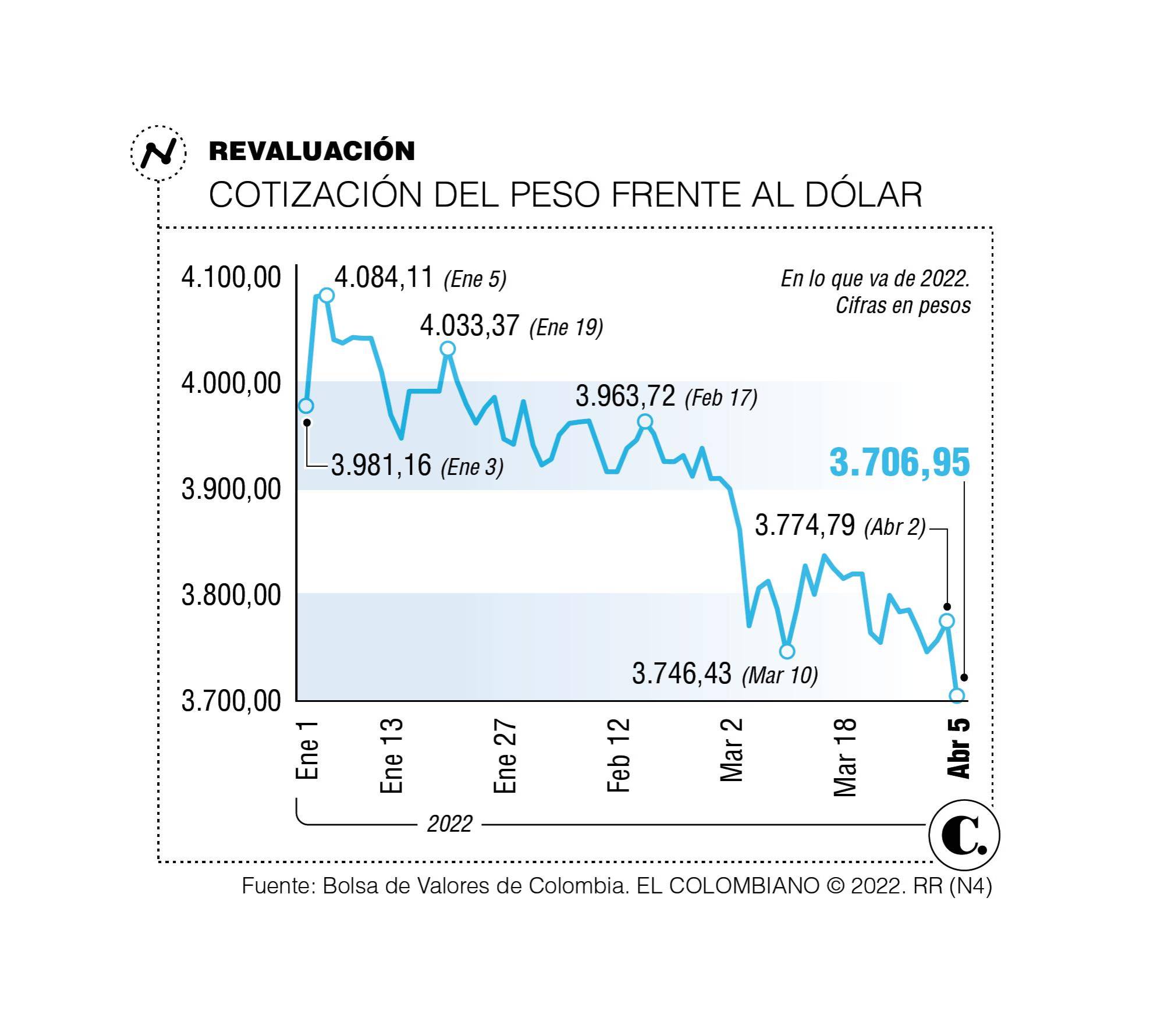

Yesterday, the dollar lost value by $35.5, and the Market Representative Rate (TRM) closed at $3,706.5 per dollar.

According to Bancolombia analysts, what happened yesterday in the Stock Exchange was catalyzed amidst the growing tensions surrounding the conflict in Ukraine, where civilian casualties continue to occur.

“This situation has led to a hardening of the discourse by European governments that intend to impose sanctions on Russian oil. In fact, the United States announced the implementation of new sanctions once morest Russia, which caused the main oil references to observe an average increase of 3.62%, once once more consolidating both references, WTI and Brent, above US$100 per barrel. ”, the experts pointed out.

These prices are convenient for the country since it improves the trade balance and tax revenues, and the more dollars that enter the economy, the less they cost and, in turn, the less we pay for imported products.

OPAs and other factors

Although yesterday’s session was interesting, the revaluation has been cooking for several weeks, since so far this year the United States currency has lost $377, since the maximum was reached on January 5 when it was quoted on the $4,084.

And here fall other factors besides external shocks, over which Colombia has no control, but rather, as Bancolombia analysts explained, the inflow of capital at the local level from the Public Acquisition Offers (OPA) launched by the Gilinski Group on the shares of Grupo Sura and Nutresa have positively favored the performance of the peso once morest the dollar.

This year alone, the Gilinski Group, through its companies Nugil and JGDB Holding, has irrigated the Colombian market with just over $9 billion, most of it in dollars, at the request of the sellers of the shares. All those available dollars helped to lower the price of the currency.

Another factor that has surely had an influence, according to Alexánder Ríos, an analyst at Inverxia, is that so far this year, government bonds have suffered strong devaluations, but with the rise in interest rates of the Banco de la República announced last week. , improve the profitability prospects for investors.

Now, it is clear that this will be a year of high volatility for the Colombian currency, as a result of the presidential elections that are already in the making. Precisely, Ríos explained that it is possible that one last factor is moving the exchange rate, as several of his colleagues have considered: “It may also happen that an electoral poll has had some effect, and given the possibility that a candidate other than Petro leads the polls provides an improvement in the international perspective of the Colombian economy”.

However, the price of the dollar remains within the projections of market experts, who calculate that during this year the exchange rate will fluctuate between $3,700 and $4,000.