Industry “1.5 trillion won in financial burden… If a new owner is not found, there is a possibility of liquidation.”

Edison protests once morest application for injunction to preserve status

Ssangyong Motor, which is in the process of revitalization, has broken up with Edison Motors and is looking for a new owner. Edison Motors was ultimately unable to solve the financial problem and suffered a disaster. Analysts say that it is unclear whether a suitable candidate will appear as more than 1 trillion won of live ammunition is required to acquire Ssangyong Motor.

○ Ssangyong Motor said that conditions are better than last year

Ssangyong Motor announced on the 28th that it had terminated its M&A investment contract with the Edison Motors consortium, the preferred bidder for the acquisition. Edison Motors signed the main contract on January 10 and paid a down payment of 30.48 billion won, which is 10% of the 304.8 billion won of the acquisition price. However, he was unable to pay the balance of 274.32 billion won within the due date. The deadline for payment of the underwriting payment was the 25th, five business days before the ‘relationship meeting date’ (April 1), when major creditors (rehabilitation secured creditors, commercial creditors, etc.) and shareholders (such as Mahindra) decide on the rehabilitation plan. Edison Motors’ manager Jeong Yong-won and Ssangyong Motor manager and EY Hanyoung Accounting Firm, the manager of the sale, requested a postponement of the meeting, but they were not accepted. Edison Motors plans to file an application for an injunction to preserve the contractor’s status to the Seoul Rehabilitation Court in protest once morest the termination of the contract.

Analysts say that some improvement in the recent business situation also influenced Ssangyong’s decision. Ssangyong Motor’s March automobile production is expected to reach 9,000 units. It surpassed 7,540 units in January and 7052 units in February, and recovered to the level of December last year (8755 units). An official from Ssangyong Motor said, “As exports increase, the number of unsold units reaches 13,000. The management situation is different from last June, when the acquisition failed. In addition, at the end of June, a new sports utility vehicle (SUV), ‘J100’, and next year’s mid-size electric SUV ‘U100’ (tentative name) are scheduled to be released. Manager Jeong said, “Compared to last year, business conditions will improve and we will be able to find more competitive acquirers.”

○ In the worst case, liquidation if a buyer cannot be found

However, there are many hurdles to overcome before a new acquisition agent for Ssangyong Motor appears. The industry is analyzing that a total of 1.5 trillion won will be needed to pay off debt and normalize business. At the time of the tender announcement last year, 11 companies submitted letters of intent to take over, but they failed to overcome the barrier of large-scale financing, and only three companies, including the Edison Motors consortium, participated in the main bid. The other two participants, Cardinal One Motors and Indie EV, also did not submit specific funding plans and were ultimately judged ineligible for the bid.

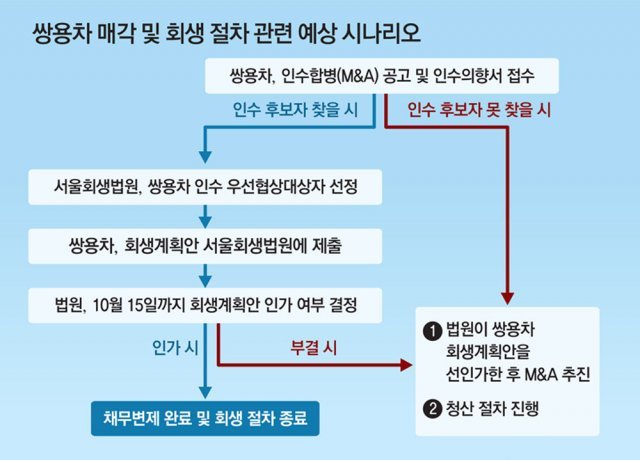

It is also burdensome that the Seoul Rehabilitation Court set the date of approval of the rehabilitation plan including the investment plan of the M&A acquirer as October 15. All procedures must be completed within a short period of 7 months. An M&A expert said, “The situation last year was that all kinds of shrimp jumped in to swallow a whale.

If Ssangyong Motor does not find a new buyer, in the worst case, it may go through liquidation procedures. Even if it is difficult to find a buyer, if the rehabilitation plan does not pass the court, the same path must be followed. If liquidation is decided, not only 4,300 SsangYong employees, but also regarding 160,000 employees of 700 primary and secondary partners and related companies might lose their jobs immediately. Ssangyong Motor estimates that the livelihood of up to 600,000 people depends on their families.

Ssangyong Motor has a way to prepare a rehabilitation plan first, obtain court approval, and then pursue an M&A. However, since last year EY Hanyoung Accounting Corporation submitted an interim report stating that the liquidation value of Ssangyong Motor is higher than the going concern value, the opinion that the possibility of realization is low. It is analyzed that KDB Industrial Bank’s plan to normalize Ssangyong Motor by injecting public funds and then pursue M&A once more is not currently on the top priority.

By Kim Jae-hyeong, staff reporter [email protected]

- like imagelike

- sad imagesI’m so sad

- angry imagesare you mad

- I want a sequel imageI want a sequel

Article Featured ImageArticle recommendation

shared imageshare

ⓒ Dong-A Ilbo & donga.com