The Federal Open Market Committee (FOMC) announced on Wednesday (16th) that it would raise interest rates by 1, and the federal funds rate came to a range of 0.25% to 0.5%, which was the first rate hike since December 2018. At the same time, the Federal Reserve (Fed) ) also revised down its economic growth forecast for this year and sharply raised its inflation forecast.

Key excerpts from the Fed’s latest rate statement and Chairman Powell’s press conference are as follows:

Key point 1: There may be 7 interest rate hikes this year

Policymakers led by Fed Chairman Powell voted 8 to 1 to raise the federal funds rate to a target range of 0.25% to 0.5%, the first rate hike cycle by the Fed in more than three years.

St. Louis Fed President James Bullard, who has always been super hawkish, voted once morest, arguing that the rate should be raised by 2 yards (50 basis points) this time.

As mentioned in the latest policy statement, the FOMC Committee expects that continued upward revisions to the target range will be appropriate.

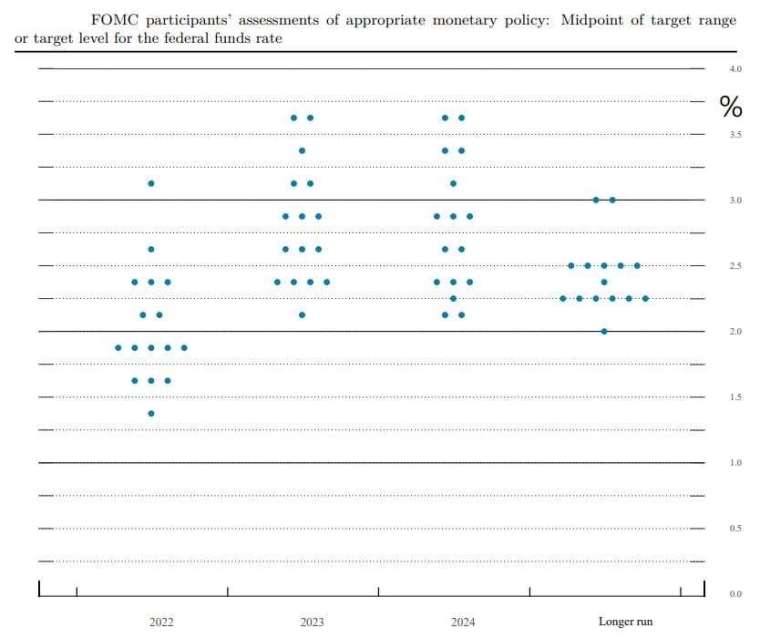

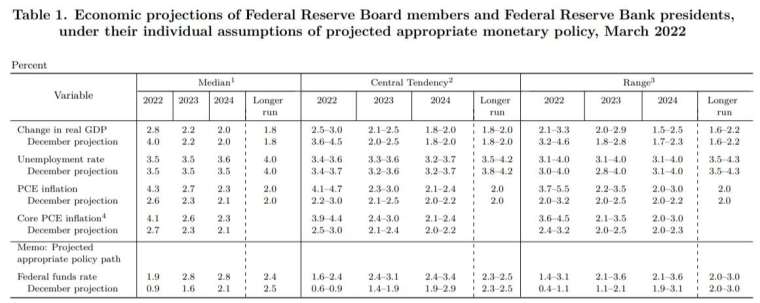

The newly released interest rate dot plot suggests that 75% of officials expect interest rate hikes in the remaining six interest rate meetings this year, with a median rate forecast of 1.9% this year, and three more rate hikes to a median of 2.8% in 2023. There will be no rate hikes in 2024.

Key point 2: shrinking the table as soon as May

The Fed seeks to achieve the dual mission of “full employment” and “2% inflation” over the long term. With the firming of monetary policy stance, inflation is expected to return to around 2% and the labor market will remain strong , the FOMC committee is expected to begin reducing its holdings of U.S. Treasuries, agency debt, and mortgage-backed securities (MBS) at a “future upcoming” meeting.

Powell said the Fed might begin shrinking its nearly $9 trillion balance sheet as early as May, and officials made excellent progress on the plan, saying it might be implemented as soon as possible at the next meeting on interest rates.

He also emphasized that the balance sheet reduction framework is similar to the last (2017 balance sheet reduction) cycle, but the execution speed is faster than the last time, and the action to reduce the balance sheet may be equivalent to raising interest rates once more.

Key point 3: Revise economic and inflation expectations

Inflation remains high, the policy statement said, reflecting supply and demand imbalances related to the pandemic, higher energy prices and broader price pressures. Ball expects inflation to return to 2%, but it will take longer than initially expected.

The Fed lowered its forecast for U.S. GDP growth this year to 2.8%, down from its previous estimate of 4%, and left its GDP growth forecast for 2023 and 2024 unchanged at 2.2% and 2.0%, respectively.

The core PCE inflation forecast for this year was revised up to 4.1%, well above the previous forecast of 2.7%. Core PCE expectations for 2023 and 2024 are also mentioned to 2.6% and 2.3%, respectively.

Unemployment is forecast at 3.5% in 2022 and 2023, the same as the forecast released in December, but revised up to 3.6% in 2024.

Point 4: The Ukrainian-Russian War brings uncertainty

The policy statement added comments on the situation in Ukraine, which read: “The Russian invasion of Ukraine is causing enormous human and economic suffering, and there is high uncertainty regarding the impact on the U.S. economy, but in the short term, the invasion and related The event might put further upward pressure on inflation and weigh on economic activity.”

Key Point 5: Economic ‘soft landing’ challenges refutation of recession

The Fed is facing the challenge of a “soft landing” in the economy, hoping to smoothly slow down the overly fast-growing economy to an appropriate rate without massive deflation and job losses.

Powell stressed that the Fed will focus on achieving price stability by addressing inflation. “Without price stability, a sustained period of maximum employment is really impossible, and this (rate hike) plan is to restore price stability while maintaining a strong labor market, which is our intention, and we believe we can,” he said. do it.”

Some argue that the Fed is too late to deal with inflation and has to do it aggressively for now, but tightening monetary policy too aggressively in an economy that is regarding to slow creates the risk of a recession or worse, stagnant inflation .

Powell pushed back once morest recession fears, arguing that the U.S. economy is strong enough to withstand tighter monetary policy.

Market Reaction

After the Fed’s policy statement was released, the market digested interest rate hike expectations, and U.S. stocks’ gains converged. S&P andDow JonesThe 2-year U.S. Treasury bond yield broke through 2%. After Powell’s press conference, all U.S. stocks closed in the red, the dollar fluctuated and fell to regarding 98.40, and the 2-year U.S. bond yield fell to regarding 1.94%.

Wall Street Analysis

“Ultimately, the Fed will send a clear message that there is a path to continued monetary tightening in response to huge inflation concerns, but the question is, is that enough?” said Jim Baird, chief investment officer at Plante Moran Financial Advisors. Do they realize they are behind the inflation curve?”

Dean Smith, chief strategist and portfolio manager at FolioBeyond, said: “Federal Reserve Chairman Powell clearly understands that the Fed really has to focus on high inflation right now, which has far exceeded their expectations, but this situation can be in the short term. It will improve internally, but it will take some time to control it.”

Economists Anna Wong, Andrew Husby and Eliza Winger said: “FOMC officials support Chairman Powell’s hawkish rhetoric that they are serious regarding containing inflation and want to raise rates faster and more significantly than previously expected.”

Mike Loewengart, managing director of investment strategy at E-Trade, said that while the Fed’s view that it will raise interest rates six more times this year is in line with market expectations, there is still a risk that monetary policy might be tightened too quickly and hinder economic growth.

“Keep in mind that there is still a risk of trying to control inflation by raising interest rates, which might impact corporate earnings and ultimately stock prices,” Loewengart said.