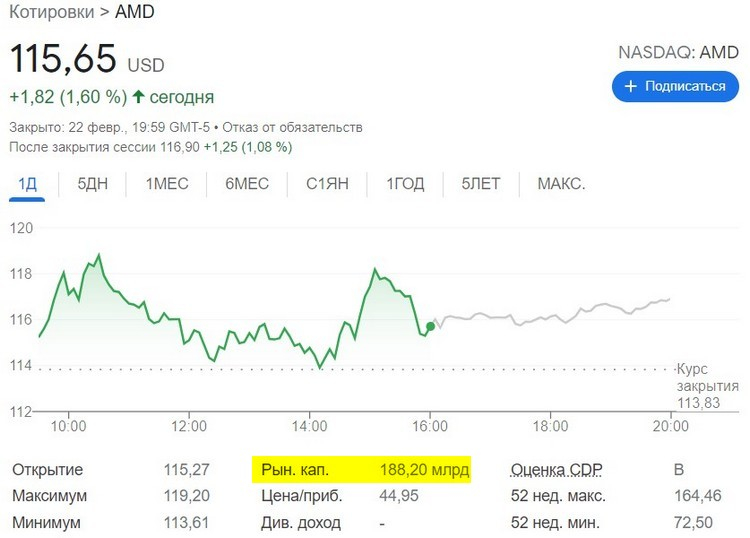

For several months in a row, the market value of AMD shares has been higher than that of Intel securities, but only in February conditions arose that allowed the first of the companies to bypass the second in terms of capitalization. Yesterday’s trading raised AMD’s figure to over $188 billion, while Intel’s capitalization dropped to $182 billion.

Image Source: AMD

This indicator is very conditional, and in practice, Intel is still able to boast of both larger revenues and a more extensive staff, but capitalization allows to some extent assess the degree of investor confidence in the company, and now AMD has this parameter for several billion dollars. higher than Intel. Yesterday AMD capitalization reached $188.2 billion, and the corresponding value in the case of Intel did not exceed $181.93 billion.

In the summer of the year before last, AMD’s capitalization barely reached $74 billion, and since then it has been able to increase quite well. At the same time, Intel’s share price managed to drop from $61.57 to the current $44.69. The speech of the Intel management at the event for investors might not convince those that in the medium term, investments in the corporation’s capital will provide an adequate financial return.

Following the completion of the Xilinx deal, AMD CEO Lisa Su expressed confidence in the ability of this structural change to generate financial synergies. She also explained that the purchase of Xilinx will not prevent AMD from increasing its revenue by 20% or more on average annually. The deal with Xilinx itself did not immediately affect AMD’s capitalization, but the optimism of investors eventually allowed this indicator to grow naturally.

If you notice an error, select it with the mouse and press CTRL + ENTER.