Enter 2022.02.12 05:04

Edited 2022.02.12 05:32

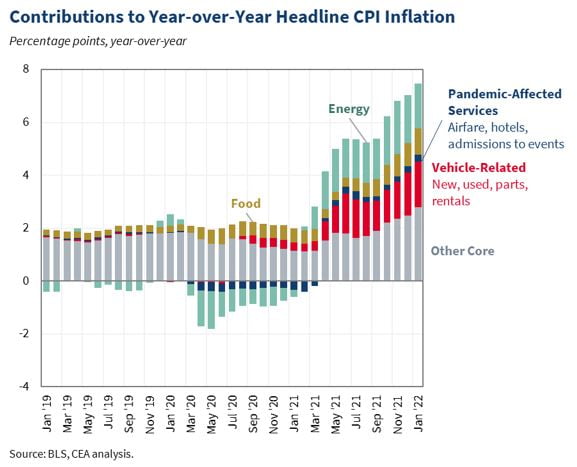

US media reports are pouring in that the US central bank (Fed) is unlikely to raise the benchmark interest rate before March or raise the interest rate by 0.5 percentage point in March. This comes amid growing expectations that the Fed will aggressively tighten austerity measures following the CPI soared to 7.5% in January, a 40-year record the previous day.

Bloomberg reported on the 11th (local time) in an article titled ‘Fed Doesn’t Yet Favor a Half-Point Hike or an Emergency Move’, “Fed members “There is no rush to raise interest rates before the Federal Open Market Committee (FOMC) in March. The higher-than-expected consumer price has given rise to such speculation, but there is no chance of a 0.5 percentage point increase in March.” . An emergency rate hike risks cementing signs and criticism that the Fed is too far behind in containing inflation, Bloomberg said. Also, Chairman Jerome Powell said last month that the pace of inflation would calm down later this year, so he said he wouldn’t be in too much of a hurry. He also added that he would have a potential shock to markets that were not prepared for a rate hike before the end of the tapering end in March. “The Fed prefers to get additional data (February CPI) before making a March rate decision,” Bloomberg said.

As CPI soared the day before, Citi, Deutsche Bank, and HSBC changed their forecasts to raise 0.5 percentage points in March. Goldman Sachs also expects the Fed to raise interest rates seven times this year instead of five. In addition, St. Louis Federal Bank President James Bullard, ‘hawk’, said, “We want to get 100 basis points by July 1, including a 0.5 percentage point increase in March.” He argued that an inter-meeting rate hike should also be considered, raising concerns regarding an emergency rate hike in the market.

However, following Bullard’s remarks, Richmond Fed President Thomas Barkin said the 0.5 percentage point increase was “conceptually open, but I’m not sure if it’s necessary to do it right now.” “It’s not my preference,” said Mary Daley, president of the Federal Bank of San Francisco. “Centrists among Fed members are skeptical of a 0.5-point hike, suggesting there is no need to start aggressively raising rates,” Bloomberg said.

The Wall Street Journal (WSJ) also reported in an article titled “Surging Inflation Heightens Fed Debate Over How Fast to Raise Rates” that “some will raise rates before the FOMC in March. There are observations, but the Fed is not going to do that.” The WSJ reported that the last time the Fed raised interest rates in an emergency meeting was in April 1994. “Fed officials also vehemently refuted market speculation that they would raise rates by 0.5 percentage points in March,” the WSJ said in a statement. “I sent a signal,” he said. He noted that the Fed will have one more opportunity to see its February inflation report before its next meeting, March 15-16.

“The Fed is still likely to take a measured approach to rate hikes despite calls for bigger,” CNBC said. action). “We will only accelerate the pace of tightening if inflation does not improve by the middle of the year and does not respond to rate hikes and balance sheet shrinking,” CNBC said. However, CNBC said, “Fed officials continue to stick to their prospects for gradual tightening even following the CPI data for January is released,” CNBC said. can,” he pointed out.

New York = Correspondent Hyunseok Kim realist@hankyung.com

ⓒ Hankyung.com, unauthorized reprinting and redistribution prohibited