It’s a new blow that falls once once more on the cryptocurrency market, and more particularly the Bitcoin (BTC) below a key level that would validate a bearish chart pattern so dreaded by investors. Still, it’s not fault for having warned you of the continuation of the ” disassembled ». Support following support, sellers are having a blast while cryptocurrency supporters see no end of the tunnel. How long can the bloodbath continue?

This Bitcoin price analysis is brought to you in collaboration with the Coin Trading and its algorithmic trading solution finally accessible to individuals.

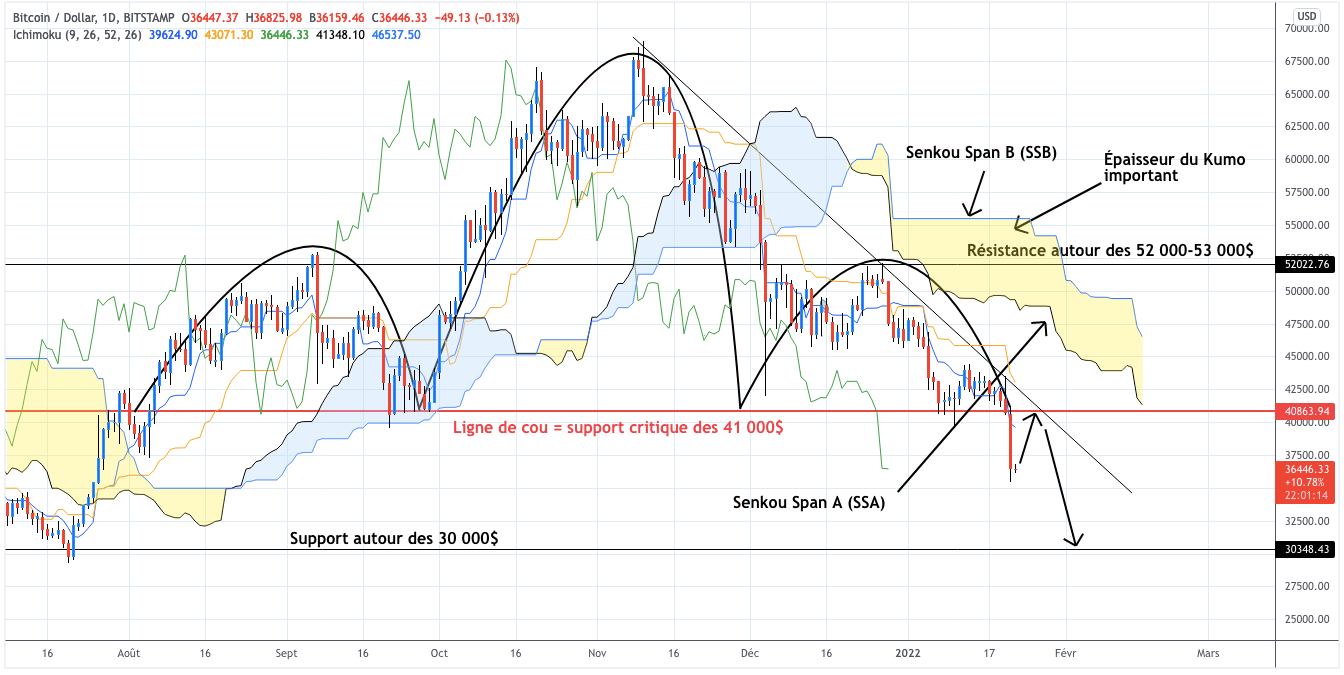

The sellers would have the last word: the final break of the critical support of $41,000 soon to be confirmed?

At present, we have to admit that the bearish momentum since its last ATH on November 10, 2021 is firmly entrenched. The king of cryptos is bearing the full brunt of the uncertainties linked to the Fed’s monetary tightening, and lately to the decline in equity indices over the past two weeks.

While the gloom is in full swing in daily units, the technical analysis of BTC in weekly units is also starting to show signs of trepidation. Could the current bloodbath add to a questioning of the long-term uptrend since the end of 2020?

This is a question mark that might soon be raised. Barring a miracle during the weekend, Bitcoin would see the critical support around $41,000 jump unceremoniously. Bitcoin is indeed trading at the time of writing around $36,300, with no signs of a potential rebound, losing more than $6,000 over the past 24 hours.

The weekly bearish candle (green dot) which gained momentum on Friday, does not breathe serenity. I would even say that the sellers are in a strong position once morest the buyers. And since bad news never comes alone, The Shoulder-Head-Shoulder Fear (ETE) Scenario would have a good chance of materializing.

For the record, the breaking of the neck line has a probability of more than 90%. The success of the final objective of the bearish chart pattern is around 63%. Which would take us to the next $30,000 support., a key level that had served as support for the king of cryptos to propel itself towards its last ATH near $69,000.

Fortunately in weekly units, cryptocurrency supporters will be pleased to see that the ichimoku indicator has temporarily kept BTC’s bottom trend afloat since the end of 2020. On the one hand, current prices seem to have found a floor at the SSB level (lower limit of Kumo). The fact that they do not evolve definitively below the Kumo might constitute a reason for hope. On the other hand, the Chikou Span is far from having said its last word once morest the horde of sellers due to its positioning above the Kumo, despite its (wide) fall below $41,000.

A dead cat bounce before $30,000?

By dint of repeating myself in relation to the latest market points on Bitcoin, investors should turn their backs, because the daily chart just pushes open doors at each broken support. Without prejudging what will happen in the coming days/weeks, I have a feeling the $30,000 support might just be a matter of time unless positive catalysts presented themselves, to everyone’s surprise.

Friday’s bearish candle that broke the ETE neck line seems to be confirmed by the next one which itself opens well below critical support around $41,000. Which would validate at this point, the bearish chart pattern waiting for next week’s close to be sure.

If we are looking for a sign of short-term optimism, the distance of the BTC prices from the Tenkan would indicate an excess of sales. A technical rebound called the “dead cat” might be triggered towards $41,000 which is now becoming a major resistance. But this would potentially only be a decoy to prepare the ground before the big slide towards the $30,000 support.

In summary, the concerns mentioned in the previous two market updates regarding the king of cryptos have unfortunately materialized. There is no doubt that the brutal breakout of $41,000 has left its mark on investors and will sow doubt among potential buyers. To make matters worse, the cacophony over the Fed’s tightening of monetary policy does not militate for risk taking on risky asset classes.

The disassembled heading towards $30,000 would signal Bitcoin prices breaking below the Kumo in weekly units, and possibly even the Chikou Span. However, this would only lead to a determines since July 21, 2021 or the end of 2020, and not a real entry into a bear market.

And if we want to concretely hope for a trend reversal, there is a risk of sport. Bitcoin should overcome many obstacles in daily units. Starting with the re-crossing of the resistance at $41,000 which would temporarily stop the downward momentum from its ATH of November 10, 2021.

Is it possible to be a winner every time? Whether the bitcoin price is in great shape, or going through turbulence, Coin Trading offers you to increase your chances of success. Indeed, Coin Trading allows individuals to access a trading tool algorithmic and 100% automated. Real trend mechanism, follow our affiliate link to test this tool designed to adapt to market reversals and position yourself on the most dynamic crypto assets of the moment.