Hello.

Chinese manufacturers have begun sending warnings to partners that battery prices will increase by 10 to 30% starting in February, which will affect the cost of final products. The market has entered a cycle of rising prices, directly related to the global crisis and inflation, which begins to accelerate to go to hyperinflation. The example of batteries, which are used in almost all portable electronics, electric vehicles and other everyday products, is interesting in order to understand what is happening and assess how the cost of all components will rise, which will affect the increase in the price of electronics.

The main suppliers of lithium, which is used in modern batteries, are China and the countries of South America (the Golden Triangle – Argentina, Bolivia, Chile), it is also worth remembering Australia. Lithium processing is a hazardous industry, there are up to a dozen companies that affect the lithium market. In some ways, this market resembles the situation with oil, with one difference – there are few countries that are significant for oil production, they determine the cost of black gold, in many respects this is the merit of OPEC +. Interestingly, the example of oil deals has become a role model for many similar industries. In fact, we are talking regarding the fact that large lithium producers agree to long deals that cover their operating costs, guarantee financial stability, and at the same time, the price within such deals is plus or minus stable and relatively low. On the other hand, there is a momentary market where the value is maximized, which gives super profits on the one hand, as well as the possibility of higher prices for long-term contracts in the future when they are re-executed. Pay attention to examples of similar economic behavior, for example, Gazprom is doing this operation with the European gas market, where spot prices are rising like an avalanche.

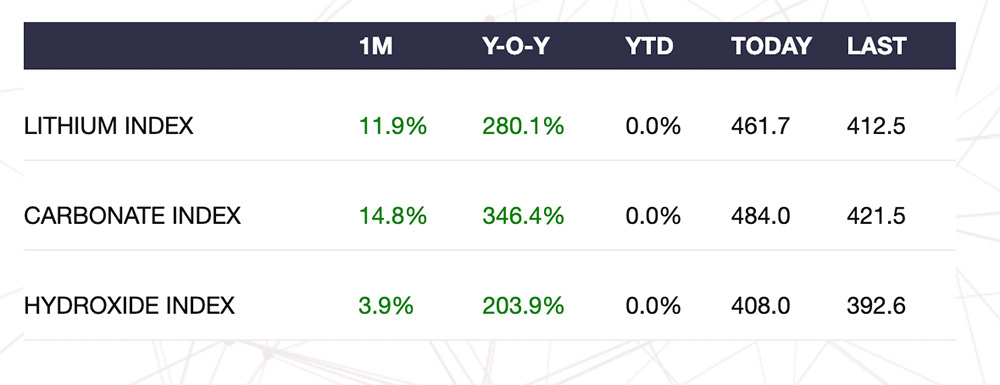

Let’s take a look at how the prices of lithium and lithium carbonate (used in the manufacture of batteries) have changed.

For the year, growth was 280 and 350%, which makes a stunning impression, but it is worth considering that the index takes into account both long-term contracts and current supply. For many manufacturers, this means that they cannot buy lithium in any derivatives at the indicated prices, and the price increased by 6 to 8 times in a year.

China launched lithium trading on the Changzhou Zhonglianjin platform last year, effectively turning lithium into a commodity. Usually in January, manufacturers sell off their stocks in order to fix profits and prepare for the new season. At the beginning of 2022, this did not happen, as futures grew by leaps and bounds. The financial market changed the rules of the game for lithium suppliers and literally made them rich, profits increased several times, while sales decreased by a third. A win-win lottery in which the company gets an excess profit, it has more product left and can throw it on the market at any time.

The crisis is such that prices begin to rise before our eyes. For example, the contract price for lithium in Changzhou in February 2022 reached 418.5 thousand yuan per ton, for comparison, this is almost 15% higher than on December 31, 2021. At the plant, the cost of lithium carbonate inside China (shipment at the plant’s warehouse) increased from 210,000 yuan per ton to 300,000 yuan in a month. Lithium hydroxide costs 192,000 yuan per ton in early December, and 290,000 yuan per ton in early January.

In South America, manufacturers have taken exactly the same position, selling small quantities at increasing prices and servicing long-term contracts. The official apology is that the cost of logistics has increased, there are interruptions in transport. But the reality is that there is uncertainty in the market that pushes prices up. And here we can talk regarding a simple thing – it is profitable to hold on to goods, raise prices in order to get additional profit out of thin air.

The crisis is developing in several directions at once, the demand for batteries is constantly growing on the part of electric car manufacturers. Until 2020, everything was more or less clear, the producers of lithium and its derivatives increased production, the price fell, and the market regulated itself. During the pandemic, it became impossible to increase production, and even unprofitable, the motivation of producers has changed (exactly the same as in other industries). Hence the crisis in production and rising prices for batteries.

In February, the cost of batteries for portable electronics will change by 10-30%, what can this mean for a smartphone? For starters, it’s worth remembering how much a smartphone battery cost in the past and flipping through BOM lists for older models. For example, for the iPhone 4, the battery cost the manufacturer $3! In the iPhone X, the battery already cost $6.5, while in the latest generation, its cost reaches regarding $10 (iPhone 13 Pro). And here you need to understand that Apple, like Samsung and other major manufacturers, has long-term contracts that allow them to offset the increase in the cost of materials and ignore local price spikes. However, the next iPhone will get a battery that will cost at least $12.50 for a similar capacity. And if you look at any large manufacturer, it becomes obvious that the increase in the cost of products is inevitable.

On long contracts, such growth is possible once every six months or once a year, that is, we observe a certain price fixing, which is not bad for such companies. But what happens to manufacturers that are smaller and buy batteries for specific batches, in the moment? But they are in big trouble. In Russia, this is clearly visible for all the creators of smart speakers, devices change their cost before our eyes, and every time it hits the wallets of companies, they cannot fix their agreements (too small production volumes, there is no priority in factories). One of the smart speakers that they started to create at the beginning of 2020 and planned to put on sale for 16 thousand rubles is consistently changing its price, at the moment the estimated price on the shelf is 22 thousand rubles, and even then it is not final, since the order has not been placed at the factory. And this is not only a matter of batteries, but of the rising cost of all components, without exception.

It is clear what will happen to batteries in smartphones and other equipment, we saw the actions of manufacturers in 2020-2021, when there was a shortage of components. Almost any components will get into the devices, the main thing is that they are and more or less cope with their task. Big companies won’t do this yet, they still have the resources, but the quality of smartphones and other electronics from C-brands will drop sharply as they try to save money and level out the increase in cost. It comes to the ridiculous, many models will receive batteries of a smaller capacity than originally intended. The reason is exactly the same – an attempt to save money. Agree that a price increase of 20-30% in the final cost of the device is very sobering and drops sales to another level.

We looked only at lithium, did not touch on other components and materials. But you can do it yourself and see how much metals cost, how their cost changes, and the price is not only rare earth metals, but also ordinary copper. Look at the chart, we are at the very beginning of the rise in copper prices.

It is conditionally possible to divide any market and components for electronics into those that are publicly available, and those that have certain restrictions. In the second scenario, we will see exactly the same approach as described above, which means a sharp increase in prices. Let me remind you that so far these are just flowers, we are on the verge of hyperinflation, which will overwhelm all countries of the world without exception. And you need to prepare for the fact that in 2023 the price increase may turn out to be multiple, that is, a conditional smartphone at the beginning of the year with a cost of 50 thousand rubles by the end of the year can cost 100 thousand rubles. The scenario is one of the most negative, and I want to believe that it will not come true. But the amount of money printed by different countries to fight the pandemic is not only so large that it is impossible to expect the absence of an increase in the cost of goods. We are at the very beginning of this cycle, and it will only swing upwards, there is simply no other option. You can draw your own conclusions, it seems to me that they do not need to be chewed.