• March is expected to be one of the most important months on Wall Street in recent years

• Market focus will be on the Non-Farm Payrolls report, inflation data, and the highly anticipated policy meeting from the Federal Reserve

• As such, investors should prepare for more wild volatility and sharp moves in the coming weeks

Wall Street stocks ended February on a decidedly mixed note, casting doubt on the durability of the rally in early 2023.

After a strong start to the year in January, the rate fell 4.2% in February, leaving the benchmark down 1.5% for the year.

Meanwhile, it has index 2.6% last month, trimming its annual gains to 3.4%. The technology-laden index fell 1.1%, dropping its level in 2023 to 8.9%.

Problems began to surface at the start of the year as investors were forced to rethink their expectations regarding how far the Federal Reserve would raise interest rates amid signs of a resilient economy and still-high inflation.

As such, the coming month is expected to be one of the most important months for Wall Street in recent years amidst a slew of market-moving events, which are likely to dictate the market direction until the end of 2023.

5 key dates on the economic calendar

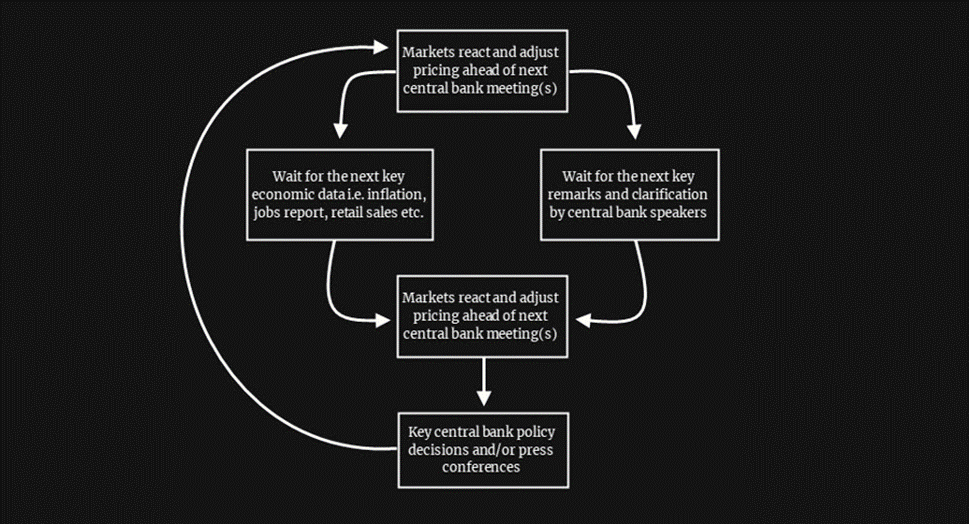

March will likely be a repeat of the past few months in terms of what markets will look to dictate price action, including the monthly jobs report, the latest inflation and retail sales numbers, as well as the upcoming Fed policy meeting.

Source: Forex Live

1. Friday, March 10: US jobs report

The US Labor Department will release its highly anticipated February Nonfarm Payrolls report on Friday, March 10th at 08:30 ET. The expectation is that the strong pace of hiring will continue, even if the increase is less than in previous months.

The consensus estimates are that the data will show that the US economy added 200,000 jobs, according to Investing.com, slowing from job growth of . Also, the unemployment rate is expected to rise to 3.5%, one mark higher than in January, a level not seen since 1969.

To put things into context, the unemployment rate was 3.8% exactly one year ago in February 2022, a sign that more interest rate hikes are needed by the Fed to rein in a volatile labor market.

Federal Reserve officials have indicated that the unemployment rate should be at least 4.0% to slow inflation, while some economists say the unemployment rate should be higher than that. Either way, the falling unemployment rate – along with healthy job gains – points to further interest rate increases in the coming months.

• Outlook: I believe the February jobs report will confirm the labor market’s remarkable resilience and support the view that the Fed’s continued efforts to cool the economy have not yet had the desired effect.

2. Tuesday, March 14: US CPI data

The scene is dominated by the February CPI report due on Tuesday, March 14th, and analysts predict that it may be more turbulent than January’s pace, suggesting that the Federal Reserve will maintain its fight once morest inflation.

While no official forecast has been set yet, the forecast for the annual CPI ranges from an increase of 6.1% to 6.5%. Consumer prices peaked at 9.1% in June and have been on a steady downward trend since then, however, inflation remains well above what the Fed would consider consistent with its 2% target range.

Meanwhile, estimates for the annual core figure center around 5.5-5.7%, compared to January. The core number is closely watched by many economic observers, including Federal Reserve officials, who believe it provides a more accurate assessment of the future direction of inflation.

• The Expectation: Overall, while the trend is down, the data is likely to reveal that both the CPI and core CPI are not declining fast enough for the Fed to slow its anti-inflationary efforts this year.

3. Wednesday, March 15th: US PPI, Retail Sales

With the Fed reliant on data, the market will pay close attention to the February PPI report as well as the latest retail sales figures, both due at 07:30 ET on Wednesday, March 15th.

The data will also take on additional importance this month, as it will be the last piece of information the Fed receives before making its policy decision.

Also, stocks sold off sharply in reporting days and last month following data showed a higher-than-expected increase in wholesale prices, while retail sales posted their biggest monthly gain in almost two years.

• Outlook: I expect the two reports to add to the growing evidence that the US economy is not at high risk of a recession yet, which in turn will continue to pressure the Fed to crack down on growth to curb prices.

4. Wednesday, March 22nd: Fed rate hike, Powell speech

The Federal Reserve will almost certainly raise interest rates by a quarter point at the close of its two-day policy meeting at 14:00 ET on Wednesday, March 22nd. This would put the target range for the fed funds in a range between 4.75% and 5.00%.

However, traders are beginning to price in the possibility of a 50 basis point rate hike, although the odds remain low at around 25%, according to Investing.com Federal Reserve Interest Rate Monitor .

But that of course might change in the days leading up to the big decision, depending on the data coming in.

Fed Chairman Jerome Powell will hold what will be a closely watched press conference shortly following the Fed’s statement release, as investors search for new clues regarding how it views inflation and economic trends and how this will affect the pace of monetary tightening.

The US central bank will also release new forecasts for interest rates and economic growth, known as a “dot chart”, which will reveal larger clues to the path of a potential rate hike by the Fed through 2023 and beyond.

Bets for a Fed rate hike have risen in the past two weeks – with the peak rate now seen in the range of 5.25-5.50% by June – following a batch of upbeat data fueled expectations that the Fed may continue to raise borrowing costs through the summer and hold on. higher for longer

• Outlook: With the economy remaining more stable than expected and inflation still rising, I expect the US central bank to take a hawkish tone at its March policy meeting. In addition, I think Powell will warn that there is still more work for the Fed to do to slow the economy and calm inflation, leading to higher interest rates in the coming months.

As such, I believe the Fed will have to raise interest rates above 5.50% sometime this year, perhaps even as high as 6.00%, before considering any idea of a pause or policy shift in their fight to restore price stability. .

5. Friday, March 31: US PCE Inflation Report

The final economic indicator for the month will arrive on Friday, March 31, when the US government releases the Personal Consumption Expenditure (PCE) price index, the Fed’s preferred inflation measure.

Wall Street was jolted last month following the ecl-906 Personal Expenses Index for January report showed that the index rose 5.4% year over year, following rising 5.3% the previous month.

Excluding the volatile food and energy components, it rose 4.7% in the past 12 months, up from an annualized pace of 4.6% in December.

• Expectation: Similar to expected results from the CPI and PPI reports, I think the PCE price data will highlight how little progress the Fed is making in its fight once morest inflation.

The bottom line

Between concerns regarding the path of higher interest rates for a longer period and accelerating inflation, I believe that US stocks will remain under pressure in March.

Furthermore, until we see signs that inflation is coming down convincingly to acceptable levels and the Fed has undoubtedly pivoted, it is unlikely in opinion that there will be a sustainable new bull market in risky assets.

As the old Wall Street saying goes, don’t fight the Fed.

• The Outlook: Investors should be prepared for a scenario in the coming weeks that might see the S&P 500 retest its mid-November low near the 3750 level – down regarding 6% from the current level – before a more aggressive decline sends the index back to a bear market low of around 3,500 during the run-up to the first-quarter corporate earnings season in April.