Norilsk Nickel shares have lost 47% since the beginning of 2022 and are now trading at regarding 12,450 rubles. If at the beginning of the year the securities looked stable relative to the market, then in the third quarter the decline accelerated.

As the reasons for the fall of shares, we single out five main points.

1. Strong ruble

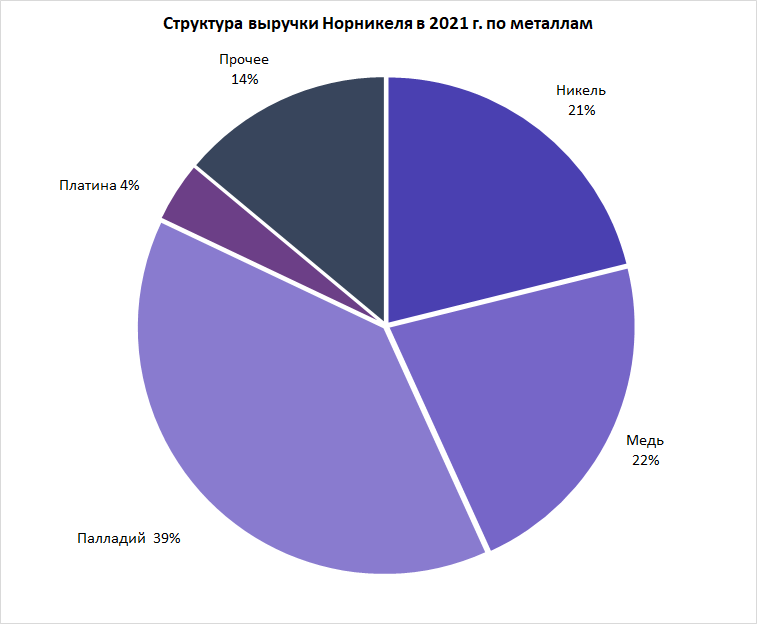

Since the beginning of 2022, the ruble has strengthened once morest the euro by almost 30% and by more than 20% once morest the dollar. For Norilsk Nickel, the exchange rate of the ruble is of critical importance, since the company works for export – at the end of 2021, only 4% of revenue came from the Russian Federation.

The strengthening of the ruble for the company means that the profitability of export deliveries is declining, and financial indicators are deteriorating. According to the results of the first half of 2022, the margin EBITDA dipped to 53.4% once morest 63.7% a year earlier. At the same time, in the first half of the year, the ruble exchange rate was much weaker than now, which means that financial results by the end of the year will be worse.

2. Prices for metals

Average realized prices for Norilsk Nickel’s key metals in dollar terms in H1 2022 were higher than a year earlier, due to a 47% yoy rise in nickel prices. However, in the second half of the year the situation began to worsen, the quotations of nickel, copper, and platinum sank. Moreover, the value of the basket of metals in rubles fell even more.

3. Deterioration of financial results

At the end of the first half of the year, financial indicators deteriorated year-on-year. One of the key points is the increase in costs and the associated deterioration in profitability. The company noted a 57% YoY increase in personnel costs, as well as a 2.3 times increase in MET expenses due to an increased tax burden from 2022.

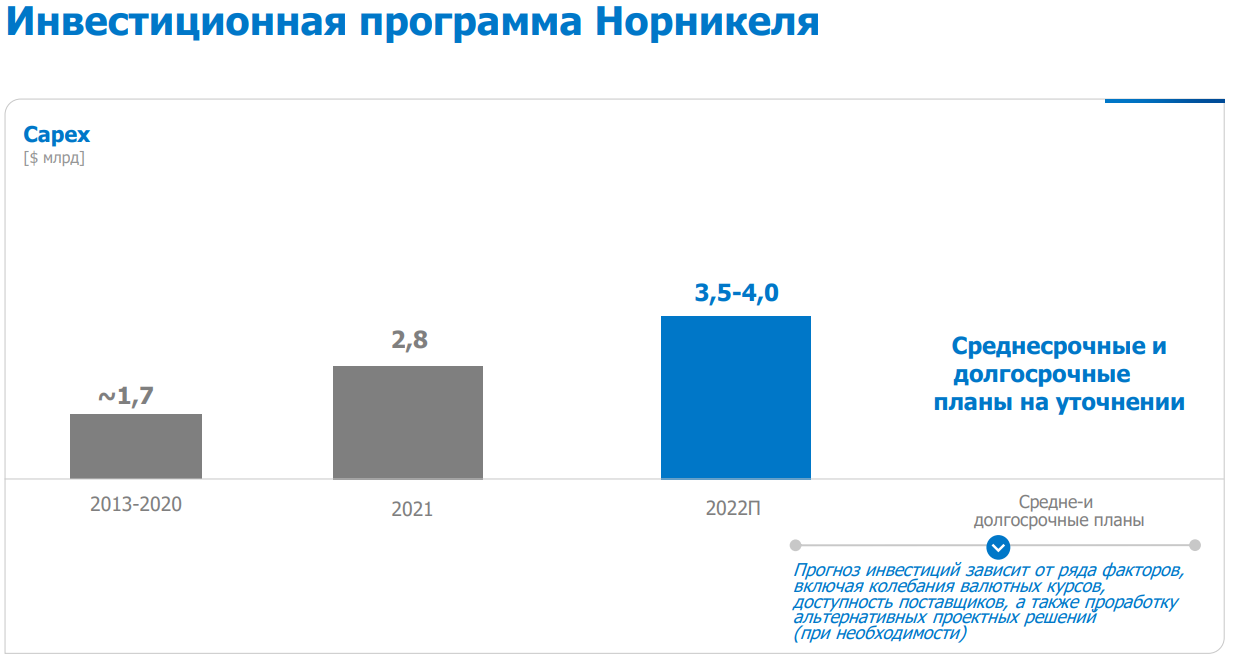

Indicative FCF, which decreased by 25% y/y, despite the fact that the result of the first half of 2021 was the weakest since 2017. The deterioration in FCF is associated with a strong increase in working capital due to sanctions, problems with logistics, and the strengthening of the ruble. In addition, the pressure on the indicator was exerted by an increase in Capex by 83% y/y and 2% h/p. Due to the decrease in FCF and due to the payment of dividends for 2021, the company had to significantly increase its debt burden, but so far it remains comfortable.

It is important that the drawdown of financial metrics will not be a one-time occurrence. According to the results of the second half of the year, the results are expected to be worse, as the ruble has strongly strengthened.

4. Reduced dividends

The first factor of pressure on dividends is the deterioration of financial indicators. The lower the profit, the less money shareholders can receive.

The second point is that in 2022 the shareholder agreement between the largest shareholders of Norilsk Nickel, RUSAL and Interros, was terminated. The agreement regulated Norilsk Nickel’s dividends and ensured a high dividend yield. Norilsk Nickel’s management previously reported that the new dividend policy involves linking the amount of payments to the FCF indicator, however, no specific decisions were made, taking into account the position of RUSAL. There is a lot of uncertainty in this matter.

The third factor is closely related to the one noted above. The FCF indicator strongly depends on the investment program being implemented – capital expenditures reduce free cash flow. In 2022–2023, the peak of Norilsk Nickel’s investment program was previously expected. Given the events of 2022, the company put the investment program for 2023 under review, but risks of growth pressure remain Capex on the amount of payments.

5. Geopolitics, sanctions and problems

The side effects of the current situation in 2022 for Norilsk Nickel, in addition to the strengthening of the ruble, include:

– problems with logistics

– difficulties with the supply of equipment

– risks associated with the sale of metals on the LME

These moments are difficult to quantify, but together they have a negative impact on Norilsk Nickel’s business.

technical picture

Norilsk Nickel shares are in a downtrend. Key support in the short term – 12,000 rubles. It is possible that the level can be broken in the next couple of weeks. In this scenario, a descent into the zone of 10,400–10,600 rubles is possible.

A positive signal might be a breakdown of 13,400 rubles. In this case, the possibility of rising to the border of a steep downtrend will open. RSI on the daily interval is close to oversold, but this is not enough for recovery.

It is difficult to identify obvious fundamental drivers for a positive revaluation of Norilsk Nickel shares in the medium term. The main problem for the company now is a strong ruble. As long as the national currency remains at current levels, securities can recover along with the market, but no more.

BCS World of Investments