Affected by the bankruptcy of Bank of America, financial stocks fell by regarding 1% this morning, and the monthly support fell. Shin Kong Gold (2888), First Gold (2892), Yongfeng Gold (2890), CITIC Gold (2891), Huanan Gold (2880) and other five gold holdings also set a new low record for this year, which is a waste of time. However, according to statistics, the number of shareholders of 14 financial holdings still increased by more than 20,000 last week. Experts’ latest analysis of financial stocks in the morning “opportunity is coming!”.

Buffett’s 2008 financial tsunami big buy Wells Fargo Expert: Opportunity is here!

The US Silicon Valley bank is closed for receivership, and the Federal Reserve will hold an emergency meeting on Monday. The market is worried regarding impacting the trend of Taiwan’s financial stocks. Lu Hanwei, a senior securities analyst, said that the financial industry in mainland China is more worried regarding the collapse of the Silicon Valley Bank in the United States. Because venture capital and emerging technology are the mainstays, the contacts are relatively close, and a self-rescue committee has been formed; After the storm, they became more cautious, so Taiwan’s financial industry did not feel the chain reaction.

Lu Hanwei cited “Stock God” Buffett’s daring to enter the market and buy Wells Fargo Bank during the 2008 financial tsunami as an example. He said that the large U.S. investment banks were not injured this time and should be limited to new venture banks. In addition, he believes that although the dividends of Taiwan’s financial stocks are obviously not good this year, in the past, the long-term stock price fluctuations of financial stocks were always when the dividends were low and the wind was turbulent. If investors are more afraid of risks, they can choose official stock banks. He believes that Taiwan’s financial strength is quite stable.

5 Financial Holdings hit a new low price this year in intraday trading today

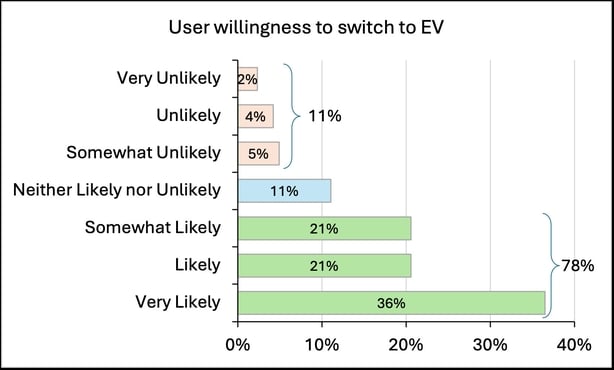

Financial stocks fell for three days in a row. The stock index once fell 20 points today, falling below the monthly support of 1538 points. According to statistics, the prices of Huanan Gold, Yongfeng Gold, CITIC Gold, First Gold, and Shin Kong Gold also hit new lows this year, but the distance is not too big. CITIC Gold, Yongfeng Gold, etc. have all fallen Convergence, try not to break the low.

Yongfeng Gold has not fallen below the current price increase of 15 yuan

Yongfeng Gold received 16.75 yuan at the end of last year, and CITIC Gold closed at 22.1 yuan. In particular, the lottery of Yongfeng Gold’s cash increase was completed last week, and the current price increase is 15 yuan. It has not fallen below the current price increase so far, and the return rate of the price difference is still regarding 10%. Shareholders also breathed a sigh of relief.

The gap between Huanan Gold and First Gold is not too big, regarding 0.15~0.3 yuan. Shin Kong Gold closed at 8.77 yuan last year, and fell to 8.35 yuan this morning. After falling due to a negative financial report last Friday, the decline was within 1.7% this morning.

Last week, the number of shareholders of financial holdings increased by 20,000, and CITIC Financial was the most

At the same time, according to the statistics of CHEP, the bad news of Bank of America broke out last Friday, but the number of shareholders did not decrease but increased, and the number of 14 financial holdings increased by more than 20,000 in a single week. Among them, the development fund increased by 4162 the most, followed by the CITIC financial increase of 3828. Other Yongfeng Gold, Yushan Gold, and Zhaofeng Gold all increased by more than 2,500 people.

Last week, the number of shareholders of financial holdings decreased by only 2, and the number of national ticket funds decreased by 1027. It should be that following the stock price rose more than 13 yuan in the short-term, some shareholders got off the car in the short-term; The only loss in the holding, the number of shareholders decreased by 149.

But on the whole, the number of shareholders of the 14 financial holdings has increased from 6,662,075 to 6,683,049, which is equivalent to an increase of 20,974 in a single week, showing that the confidence of financial stockholders has not loosened.

further reading

-

Ye Yiru, Special Correspondent of Yahoo Finance: 22 years of experience in financial mainstream media, from the bubble of Web1.0 in 2000 to Web3.0 of the Meta universe, witnessed the history of the rise and fall of large and small business groups in Taiwan, and experienced five international financial crises. Think that finance is life, omnipresent, no matter how difficult financial management knowledge should be explained in a simple way. No matter you are young or old, you should manage money. If you don’t manage money, money will ignore you.