2024-05-13 09:15:15

Registered2024.05.13 18:15

Edit2024.05.13 19:17

surfaceAT 12

China issues special long-term government bonds

First published on 17… Maturity up to 50 years

Producer prices remain negative for 19 consecutive months

Everything is being done to revive domestic demand in a context of “real estate slowdown”China’s debt ratio is lower than that of developed countries

2.25 times ↑ in 10 years… The increase is strong

The burden of unconfirmed “phantom debt”

The Chinese government is trying to stimulate the economy by issuing 1 trillion yuan (regarding 189 trillion won) of special long-term government bonds. This is a special measure introduced by the Chinese government to revive the market which has fallen into recession due to the deterioration of the real estate market.

○Issuance of special bonds for the first time in 4 years

China’s Ministry of Finance announced on the 13th that it would issue “2024 Special Long-Term Government Bonds” with maturities of 20, 30 and 50 years, respectively. Although the Ministry of Finance did not mention the amount of the issuance, Bloomberg News cited an official and said it was 300 billion, 600 billion and 100 billion yuan, respectively. The 30-year bonds will be put on the market on the 17th, and the 20- and 50-year bonds on June 24 and 14 respectively. The Financial Times (FT) reported that tax authorities met with bond managers of major commercial banks and discussed the price of issuing special bonds.

Premier Li Chang of the State Council said at the National People’s Congress in March: “We will issue special super-long-term government bonds starting this year.” » Premier Li explained that the special bonds are used to realize major national strategies and strengthen basic security capabilities.

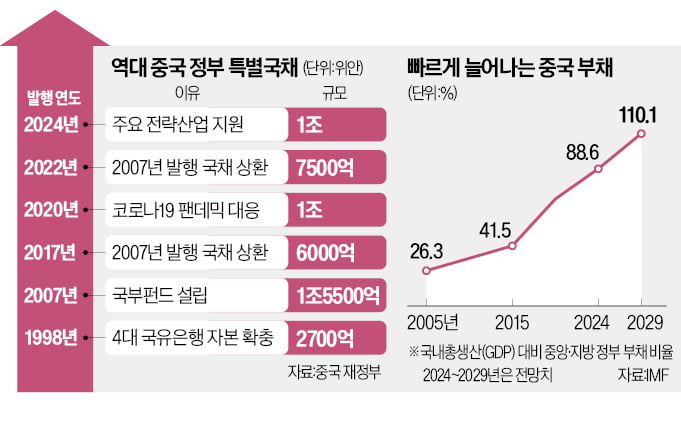

This is the fourth time the Chinese government has issued special bonds, not including reissues to repay existing government bonds. Chinese tax authorities issued special bonds worth 270 billion yuan in 1998 to increase the capital of the four major state-owned banks, and 1.55 trillion yuan of special bonds to establish the China Investment Corporation (CIC) , a sovereign wealth fund, in 2007. To respond to the pandemic, 1,000 billion yuan was put on the market. The market believes that the purpose of this special bond issue is to revitalize the national economy, which has foundered due to the real estate recession. The April producer price index (PPI) announced by the Chinese National Bureau of Statistics on the 11th fell by 2.5% compared with the same month last year. Even if the drop was less than the previous month (-2.8%), it remained negative for 19 consecutive months.

Ding Shuang, chief economist for Greater China at Standard Chartered (SC), said the special bond issue “will help accelerate fiscal spending, which has been slow so far,” and added: “Good execution budget will maintain the country’s positive growth dynamic. first quarter and achieve an annual growth rate of 5%. “This can increase the possibility of achieving a high growth rate,” he said.

○Chinese debt has multiplied by 2.3 in 10 years

The market believes that China’s national debt remains at a manageable level. However, the recent rapid increase in debt and the serious problem of hidden debt of local governments raise fears of a negative impact on domestic and international markets in the future. According to the “Fiscal Monitor” report released by the International Monetary Fund (IMF) last month, China’s national debt to gross domestic product (GDP) ratio last year was 83.6%, which is low compared to that of the United States (122.1%) and developed countries (111%). Jameson Zuo, director of Hong Kong credit rating agency CSPI, said: “By global standards, China has the opportunity to issue billions of yuan of bonds over the next five to 10 years . »

However, China’s national debt ratio increased by 2.25 times compared with 10 years ago, a sharp increase compared with that of the United States (1.17 times) and countries developed (1.06 times). The IMF predicts that China’s national debt ratio will reach 110.1% in 2029, equal to that of the group of developed countries.

“Phantom debt” held by Chinese local governments is also one of the potential factors threatening the Chinese economy. Asset management company Fidelity has diagnosed that China’s national debt ratio exceeds 130%, including local government financing vehicle (LGFV) debt. LGFV is a special company under the local government established for infrastructure development and financing. LGFV debt is called phantom debt because it is not included in central government debt statistics. Foreign media analyzed that this special bond issue was also the result of the central government taking the initiative in favor of local governments that were unable to increase their debt. Some point out that the global economy will fall into an inflation swamp as the United States and China, the two main axes driving the global economy, both significantly increase their budget deficits. Indeed, if both countries increase the amount of their government bond issuance, government bond prices might fall and interest rates might skyrocket.

“How the two economies manage their fiscal policies might have significant implications for the global economy and present significant risks to the fiscal outlooks of other countries,” the IMF warned.

Journalist Kim In-yeop [email protected]

1715608154

#growth #target.. #China #releases #billion #yuan #stimulate #economy