Bitcoin’s Recent Dip: A Calculated Move or Market manipulation?

Table of Contents

- 1. Bitcoin’s Recent Dip: A Calculated Move or Market manipulation?

- 2. What’s Behind the Drop?

- 3. Bitcoin’s Resilience: A Silver Lining?

- 4. High-Risk Sentiment Looms

- 5. Key Takeaways

- 6. Where Could Bitcoin Find Its Next Support Level?

- 7. What are some key indicators investors and traders should monitor in the Bitcoin market?

- 8. Key Factors to Watch:

- 9. Conclusion:

Bitcoin, the world’s leading cryptocurrency, recently experienced a 5% drop, bringing its price down to $95,000.This decline, marked by a glaring red candlestick on the daily chart, has left many investors scratching their heads. Unlike previous dips caused by market overheating, this one appears to be driven by something more deliberate.

What’s Behind the Drop?

While technical indicators showed no signs of an impending downturn, the sudden drop has sparked speculation about potential market manipulation. “This doesn’t feel like a typical correction,” one analyst noted. “It seems more like a calculated move.”

Adding to the intrigue,recent economic data paints a picture of a resilient U.S. economy. Strong PMI numbers and high job openings suggest stability, yet volatile assets like Bitcoin have taken a hit. This marks the second significant crash in less than a month, raising questions about the underlying forces at play.

Bitcoin’s Resilience: A Silver Lining?

Despite the dip, Bitcoin has shown remarkable resilience. Just two weeks after hitting a record high of $108,000, it plummeted to $91,000, only to bounce back to $100,000 within seven days. this pattern of recovery is not new for Bitcoin, which has a history of rebounding swiftly, especially when institutional investors step in to capitalize on liquidity.

Even as the dollar index (DXY) reached a two-year high of 109.27, Bitcoin’s 5% decline still demonstrates underlying strength.This suggests that the cryptocurrency remains a formidable player in the financial markets, capable of weathering short-term volatility.

High-Risk Sentiment Looms

Though, not all signs are positive. The market is currently gripped by a “high-risk” sentiment, with over $114 million in long positions wiped out. funding rates are steadily declining, indicating a cautious approach among traders. This uncertainty could delay Bitcoin’s recovery, even as institutional interest grows.

As the crypto market continues to evolve, one thing is clear: Bitcoin’s journey is far from predictable. Whether this recent dip is a sign of manipulation or a natural market fluctuation, investors must stay vigilant and informed to navigate the volatile landscape.

Key Takeaways

- Bitcoin’s recent 5% drop to $95,000 appears to be a calculated move rather than a market correction.

- strong economic data contrasts with the dip in volatile assets, suggesting potential manipulation.

- Bitcoin has a history of swift recoveries, often driven by institutional investors.

- High-risk sentiment and declining funding rates indicate caution among traders.

In the ever-changing world of cryptocurrency, staying informed and adaptable is key. Whether you’re a seasoned investor or a newcomer, understanding the nuances of Bitcoin’s market behavior can help you make smarter decisions in this high-stakes environment.

Bitcoin’s recent price movements have left many investors on edge, notably retail traders and day traders who are cautiously waiting for the right moment to jump back in. The cryptocurrency’s current valuation, hovering around $5,000, is far from its previous highs, creating a psychological barrier for those hoping to capitalize on potential gains.

Experts suggest that a significant price gap between the current level and the $102,000 mark could serve as a catalyst to reignite market confidence. This potential trigger point is being closely monitored by analysts and investors alike, as it could signal a turning point for Bitcoin’s trajectory.

Where Could Bitcoin Find Its Next Support Level?

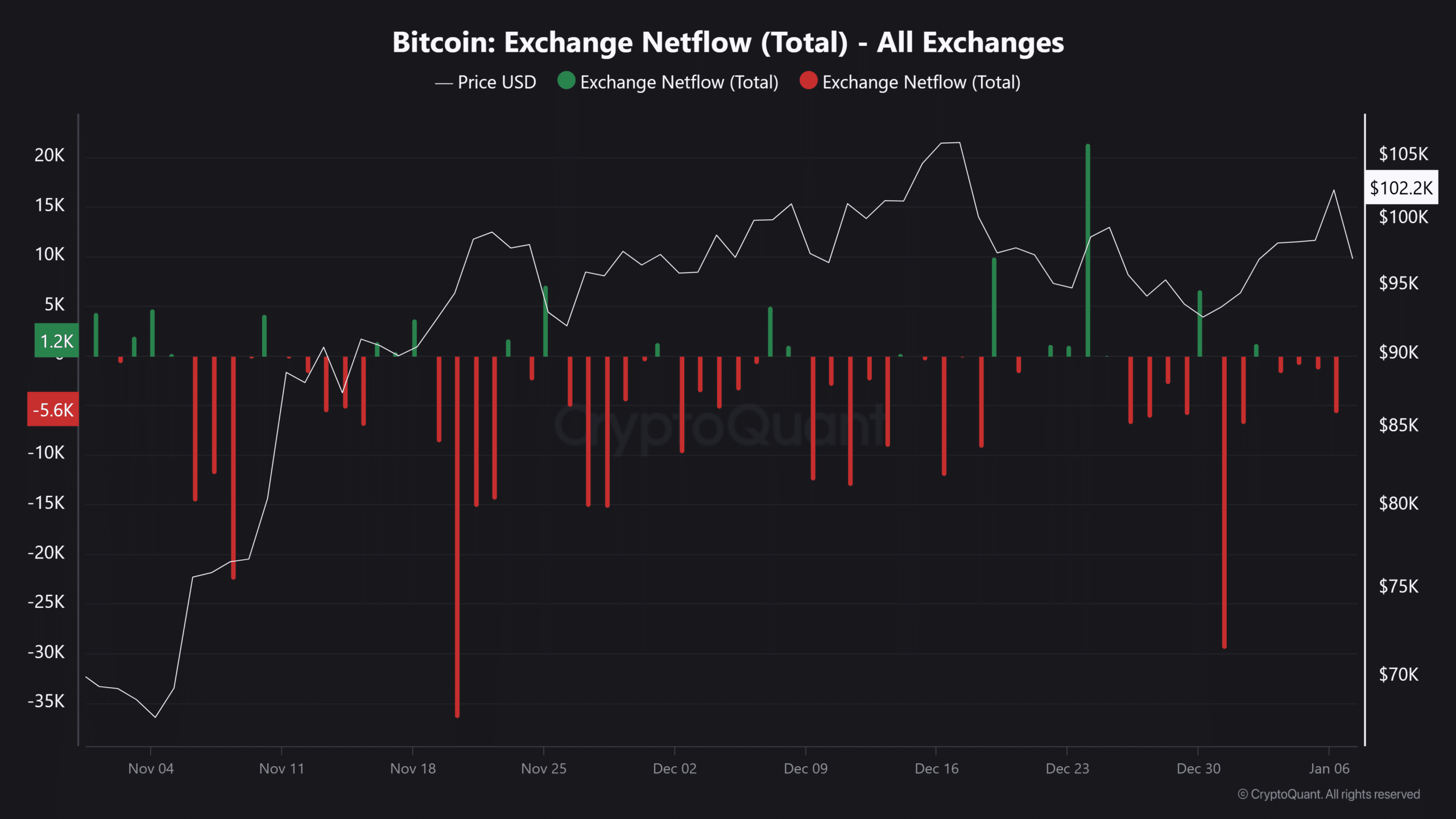

When Bitcoin recently dipped to $91,000, it staged a remarkable recovery, fueled by a surge in retail investment. At that time,net outflows reached $25,000—the highest in a month. Though, the current scenario paints a different picture. While net flows have turned negative, they remain relatively modest at just $5,000, indicating a more cautious market sentiment.

This shift in dynamics raises questions about where Bitcoin might find its next bottom. The interplay between retail capital and market outflows will likely play a critical role in determining the cryptocurrency’s near-term direction. As traders and investors weigh their options, the market remains in a state of flux, with potential opportunities and risks on the horizon.

As the market continues to evolve, one thing is clear: Bitcoin’s journey remains as unpredictable as ever. Whether the next bottom will be a springboard for recovery or a deeper plunge remains to be seen, but the stakes are high for all involved.

The cryptocurrency market remains in a state of flux, with Bitcoin’s price movements continuing to capture the attention of investors and analysts alike. Recent data suggests that the much-anticipated “buy-the-dip” moment has yet to materialize, indicating that the market is still waiting for a decisive catalyst to drive momentum.

Market participants,still reeling from the aftermath of a recent downturn,may need to brace themselves for a period of prolonged uncertainty. While hopes for an immediate recovery linger,the reality is that patience will likely be a key virtue in the coming weeks. A swift rebound seems unlikely, but a potential pullback to the $89,000–$91,000 range could present a strategic entry point for those looking to capitalize on the next upward trend.

This cautious sentiment is reflected in the broader market dynamics, where traders are closely monitoring key indicators to gauge the next move.the lack of significant net inflows into exchanges suggests that investors are holding onto their assets, waiting for clearer signals before making their next play.

For those navigating this volatile landscape, the key takeaway is to remain vigilant and avoid impulsive decisions. While the market may test your resolve, understanding the underlying trends and maintaining a long-term perspective could prove invaluable in weathering the storm.

What are some key indicators investors and traders should monitor in the Bitcoin market?

A further descent into volatility is yet to be seen. Investors and traders must remain vigilant, keeping a close eye on key indicators such as net flows, funding rates, and institutional interest to navigate this complex and ever-changing landscape.

Key Factors to Watch:

- Net Flows: The balance between inflows and outflows from exchanges can provide insights into market sentiment. negative net flows may indicate a shift toward holding rather than trading, which could stabilize prices in the long term.

- Funding Rates: Declining funding rates suggest that traders are becoming more cautious, possibly reducing leverage and speculative activity. This could lead to a more stable market but may also delay significant price movements.

- Institutional Interest: Bitcoin’s ability to recover from dips has often been driven by institutional investors. Monitoring their activity, such as large purchases or withdrawals, can provide clues about future price trends.

- Psychological Barriers: Price levels like $95,000 and $102,000 serve as psychological barriers for traders. Breaking through thes levels could trigger renewed confidence and buying activity.

- Market Manipulation: The possibility of market manipulation remains a concern, especially given the contrast between strong economic data and Bitcoin’s recent dip. Investors should remain cautious and consider the broader context of market movements.

Conclusion:

Bitcoin’s recent price movements highlight the cryptocurrency’s inherent volatility and the challenges of predicting its trajectory. While the market is currently in a state of uncertainty, with high-risk sentiment and declining funding rates, Bitcoin’s history of swift recoveries and growing institutional interest offer reasons for cautious optimism.

For investors, staying informed and adaptable is crucial. By closely monitoring key indicators and understanding the nuances of Bitcoin’s market behavior, they can make more informed decisions in this high-stakes environment. Whether Bitcoin’s next move is upward or downward, the cryptocurrency’s journey remains a fascinating and unpredictable one, offering both opportunities and risks for those willing to navigate its complexities.