By 2060, the health insurance deficit is projected to overtake the government deficit. Health insurance is expected to fall into a chronic ‘deficit swamp’ from next year, and it is analyzed that the deficit will increase every year and reach an uncontrollable level. This is because bills for “Moon Jae-in Care,” which excessively widened the scope of coverage in a rapidly declining birthrate and aging society, are piling up. Nonetheless, in the political world, the stopgap measures of ‘increased government subsidy’ are prevailing while ignoring health insurance reform.

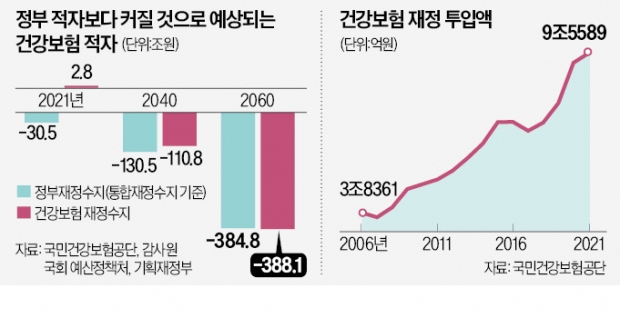

On the 16th, the Korea Economic Daily cross-analyzed the National Health Insurance Corporation’s long-term fiscal projections and the National Assembly Budget Office’s long-term fiscal forecast, and as a result, in 2060, the health insurance deficit was 388.1 trillion won, which is the government’s integrated fiscal deficit ( 384.8 trillion won).

Health insurance was in the black before the Moon Jae-in administration, but recorded a deficit from 2018 to 2020. Last year and this year, hospital visits decreased due to Corona 19 and turned to surplus, but next year it will turn into a deficit once more and it is expected that it will be difficult to escape the deficit following that.

In particular, the deficit is expected to increase exponentially following 2030, reaching 110.8 trillion won in 2040, 246.6 trillion won in 2050, and 388.1 trillion won in 2060. It is close to impossible to make up for this health insurance deficit with government fiscal input. In this case, the government deficit as a percentage of gross domestic product (GDP) would jump from -11% to -23.9% in 2060. A senior economic official said, “There are many concerns regarding the national pension deficit, but the health insurance deficit is more serious than that.”

The problem becomes even more serious when long-term care insurance, which is expected to lose 63 trillion won in 2060, is added. However, it is pointed out that the opposition party is focused only on expanding financial support instead of health insurance reform, and the Ministry of Health and Welfare, which is in charge, does not show a clear will for reform.

The trap of aging and cultural care… To make up for the health insurance deficit, 70% of tax revenue must be spent

Health insurance deficit forecast of 388 trillion won in 2060… 277 times increase when tax revenue increases by 39%

Health insurance, which recorded surplus for two consecutive years this year and last year, will turn into a deficit starting next year. The government’s projected deficit next year is 1.4 trillion won. As of the end of last year, the health insurance reserve amounted to 20.24 trillion won, which is enough to cover. However, as the health insurance deficit continues, the health insurance reserve is expected to bottom out in 2028. Moreover, the speed at which the health insurance deficit is expanding is expected to be much faster than the speed at which government revenues, such as tax revenue, increase in the future. As it is difficult to cover the health insurance deficit only with reserves and financial input, there are observations that a significant increase in the health insurance fee rate will be inevitable.

○ Health insurance deficit greater than tax revenue increase

According to the National Assembly Budget Office on the 16th, national tax revenue is expected to record 555.7 trillion won in 2060. It is expected to increase gradually, such as 421 trillion won in 2030, 477.1 trillion won in 2040, and 523.1 trillion won in 2050. Compared to next year’s expected tax revenue of 399.4 trillion won, it will increase by 39.1% over the next 37 years.

The growth rate of the health insurance deficit is much faster than this. According to the long-term financial forecast submitted by the National Health Insurance Corporation to the Board of Audit and Inspection, the deficit will increase rapidly from 20.2 trillion won in 2030 to 110.8 trillion won in 2040, 246.6 trillion won in 2050, and 388.1 trillion won in 2060. Considering that a deficit of 1.4 trillion won is expected in 2023, the deficit in health insurance increases 277.2 times while tax revenue is collected by 39% more.

Long-term care insurance is also expected to see a significant increase in deficit. According to the long-term care insurance estimate data submitted by Congressman Lee Jong-seong from the National Assembly Budget Office, the long-term care insurance deficit was 3.8 trillion won in 2030, 23.2 trillion won in 2040, 47.6 trillion won in 2050, and 63 trillion won in 2060. It will be expanded to 4 trillion won and so on.

If this prospect becomes a reality, 81% of tax revenue (70% for health insurance and 11% for long-term care insurance) will have to be invested to resolve the deficit in health insurance and long-term care insurance in 2060. However, the government’s financial support for health insurance (20% of the expected income from health insurance) and the balance between health insurance and long-term care insurance were not taken into account in this calculation.

○ “The health insurance rate may be 24% or higher”

In the end, there are observations that a huge health insurance deficit will lead to a sharp increase in insurance premiums. The projected health insurance deficit of 388 trillion won in 2060 is a forecast assuming that the current health care income and expenditure structure will be maintained.

According to the National Health Insurance Act, the upper limit of health insurance premiums is 8%. The insurance premium rate applied next year is 7.09%, which is already close to the upper limit. If the size of the health insurance deficit expands, it is expected that there will be a demand to raise the upper limit of insurance premiums through amendments to the Health Insurance Act. Kim Yong-ha, a professor of IT finance management at Soonchunhyang University, predicted, “If the current structure is maintained, the health insurance premium rate will have to be raised to more than 24%.”

○ Aging is getting worse… Spending structure needs to be improved

The difficulty of resolving the aging problem is also pointed out as a factor threatening the sustainability of health insurance finances. The proportion of the elderly (aged 65 or older) in Korea is expected to rise from 15.7% last year to 43.8% in 2060 and 46.4% in 2070. The elderly population is the age group that mainly receives health insurance benefits following retirement.

On the other hand, the working-age population who must pay insurance premiums will decrease from 72.1% last year to 46.1% in 2070. In 2070, the working-age population will be smaller than the elderly population.

The Board of Audit and Inspection pointed out that improvements in expenditure are necessary for the sustainability of the health insurance system. In the case of the medical care benefit expenditure management system, the need to revise the fee system for each act that causes excessive medical treatment was raised. He also said that the amount of compensation for losses to the medical community, which has been paid since the last government’s measures to strengthen health insurance coverage, the so-called ‘Moon Jae-in Care’, should be recalculated to determine the appropriate amount.

Kang Jin-kyu/Kwak Yong-hee reporters [email protected]