Exchange rate 1205.5 won… Best in 18 months

Withdrawal of Hyundai Engineering’s listing plan

The domestic stock market, which had crashed on austerity warnings from the US Federal Reserve, rebounded in five trading days. However, the volatility trend is expected to continue due to the foreign exodus (great escape) and the downward trend in corporate earnings forecasts.

On the 28th, the domestic stock market produced a roller coaster market. The KOSPI fell below the 2,600 mark for the first time in 14 months. However, as the buying trend of individuals and institutions revived, the index raised the index. In the end, it closed at 2,663.34, up 1.87% from the previous trading day. The KOSDAQ index also rose 2.78% to close at 872.87.

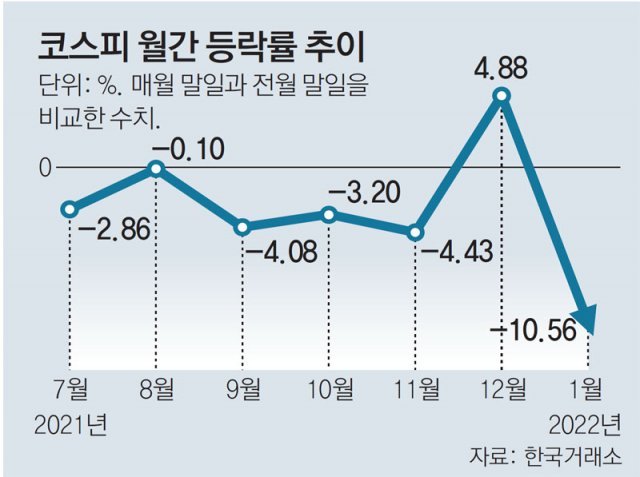

The KOSPI plunged 10.56% in the month of January. The drop was the biggest since March 2020, when the spread of the novel coronavirus infection (COVID-19) began in earnest. Seo Cheol-soo, head of Mirae Asset Securities’ research center, said, “Uncertainty in corporate earnings can increase share price volatility.” As volatility increased, some companies withdrew from listing. Hyundai Engineering announced on the same day that it had submitted a notification of withdrawal of public offering. As the market fluctuated, authorities began to evolve. “It is not desirable to have excessive anxiety,” Koh Seung-beom, chairman of the Financial Services Commission, said at a financial market inspection meeting on the same day.

However, following selling more than 1.7 trillion won in the domestic stock market the day before, foreigners net sold 700 billion won worth of stocks on the same day. Foreigners’ departure is fueling the won-dollar exchange rate rise (the won’s depreciation). This is because foreigners sell stocks and exchange them for dollars, which causes the won-dollar exchange rate to rise sharply. On the same day, the won-dollar exchange rate in the Seoul foreign exchange market closed at 1205.5 won, up 2.7 won from the previous trading day. This is the highest level in one year and six months since July 16, 2020 (1205.6 won).

Reporter Park Min-woo [email protected]

Correspondent Dongsoo Choi [email protected]

- like imagelike

- sad imagesI’m so sad

- angry imagesare you mad

- I want a sequel imageI want a sequel

Article Featured ImageArticle recommendation

shared imageshare

ⓒ Dong-A Ilbo & donga.com