This year, the number of unsold homes has increased significantly across the country. Loans have become difficult due to high interest rates, and as the wait-and-see situation has intensified due to the perception of high house prices, the number of unsold homes in the metropolitan area and provincial areas has increased significantly.

This trend is likely to worsen in the future. So, should you never buy an unsold home? How do I judge an unsold apartment?

An increasing number of unsold… 31,000 households

Unsold housing refers to the unsold housing that has been sold to the general public following receiving approval from the government for sale. In Korea, where ‘pre-sale’ is the majority of the sale of apartments before they are built, general unsold and ‘unsold following completion’ are separately counted.

Unsold following completion of construction is a case in which the sale of the apartment is not completed even following the completion of the occupancy. It usually takes 2-3 years from sale to move-in, but it is also called ‘malignant unsold sale’ in the sense that it was not sold during this period.

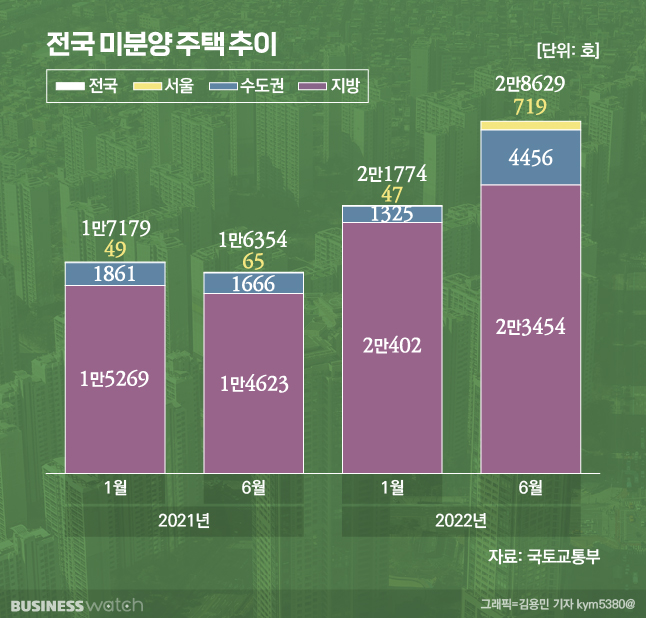

According to the National Unsold Housing Status of the Ministry of Land, Infrastructure and Transport, as of July last year, a total of 31,284 unsold housing units nationwide. Considering that the number of unsold housing units never exceeded 20,000 throughout last year, the popularity of the houses sold this year was relatively low.

The number of unsold homes increased from the end of 2021. It increased 39.7% from 7,388 households in November last year to 17,710 households in December. In January of this year, there were 21,727 households, an increase of 22.7% in just one month. After that, it steadily increased to 25,254 households in February and 27,974 households in March, and then increased to 30,000 households in July.

It is the same trend in Seoul and Gyeonggi-do, where there is always a lot of demand. In the case of Seoul, the number of unsold homes in February this year was only 47, but it increased every month to △180 households in March △360 households in April △688 households in May △719 households in June. However, in July, 127 households decreased to 592 households. Gyeonggi-do has increased from 855 households in January to 3,393 households in July.

After construction, the number of unsold units also increased. As of July, the number of unsold housing units nationwide following completion was 7,388, an increase of 285 units (3.6%) from the previous month. In Seoul, 178 households (481.1%) increased with the completion of ‘Cantabile Suyu Palace’ in Suyu-dong, a post-sale complex in June. As soon as the controversy over the high sale price of this complex, which moved in four months following the sale, began to sell out by discounting the sale price. As a result, in July, 64 households decreased to 151 households.

Non-apartments at high prices, unsold in the end

Let’s take a closer look at the unsold houses in Seoul. Most of these are urban living houses and officetels, and there are many cases where the size of the houses is small. As of the end of last month, ‘Hillstate Cheongnyangni Metroble’, with 52 unsold houses remaining, is small with an exclusive area of 26 to 48 square meters. ‘Belive the ABLE’, with 245 unsold out of a total of 256 households, is also a 38-49㎡ urban living house.

Urban living houses were less regulated than apartments, so they were a strong substitute, but demand fell sharply as the real estate market slumped due to interest rate hikes and other factors. There was also a controversy over the high sale price because the price ceiling was not applied. Hillstate Cheongnyangni Metro sold for a maximum of 899.7 million won in the case of a 48 m² dedicated area, and the Belive the Able sold over 900 million won in a 42 m² exclusive area.

On the other hand, there are cases where it is counted that there are unsold houses even in the complex where the current market price has risen significantly compared to the sale price. In the past, it failed to sell out at the time of pre-sale, but following that, the construction company holds the unsold property without selling it.

Jichuk-dong, Goyang-si, Gyeonggi-do is a typical example. This complex, with 19 unsold units, was sold for 400 million won in 2017, and the current asking price is between 1.1 billion won and 1.2 billion won. If we sell it now, a lot of profit is expected, but Hallim E&C explained that it does not plan to sell it because it is using these supplies for employees’ lodgings.

‘Yojin Y House (44 unsold households)’ in Pungdong, Ilsan-dong, sold in 2012, and ‘Dongtan Station Yurim Norwegian Forest (13 unsold)’ in Osan-dong, Hwaseong-si, which were sold in 2012, also increased by hundreds of millions of won compared to the sale price, but unsold volumes This remains.

Unsold apartments should also be covered with ‘jade’

If so, can I buy an unsold apartment? There must be a lot of people who are worried regarding this. If it is an unsold apartment, it is natural that you should look more closely at the sale price, location, and market price.

Usually, suppliers, such as builders and contractors, measure the sales performance in 3, 6, and 12 month units. “Sold out (completely sold)” within 3 months means that most of the winners of the subscription completed the contract. It usually takes 6 months to complete the sale through non-priority tendering. For complexes with relatively poor location, some set the goal of selling them slowly for one year.

From the point of view of consumers, it seems that the longer the sale period, the lower the product quality. It is the ‘initial sale rate’ that measures this. The ratio of the number of households that completed the contract within six months of the start of the sale to the total number of households for sale is called the ‘initial sale rate’. According to the Housing and Urban Guarantee Corporation (HUG), the nationwide initial sale rate in the second quarter of this year was 87.7%. In Seoul, Busan, Daejeon, Sejong, and Jeonbuk, the initial sales rate reached 100%. Incheon and Gyeonggi Province have high initial contract rates of 99.9% and 95.9%, respectively.

On the other hand, during the same period, Daegu (18%), Ulsan (35.4%), and Gangwon (64.6%) had low initial contract rates. It must be said that these places take a long time to exhaust unsold units. If you are an end user, you should pay attention to these points.

Unsold apartments must also be covered with boulders. There must be a reason why it doesn’t sell as unsold. On the other hand, if it is a key location such as Gangnam, Seoul, and is a promising area in the mid- to long-term, it may be an opportunity to buy a house.

Even among the apartments in Seoul that are now worth billions of dollars, there are many complexes with an unsold past. Banpozai·Raemian First in Seocho-gu, Godeok I-Park in Gangdong-gu, Galleria Foret in Seongdong-gu, etc.

These are the complexes sold in 2008-2009, when the real estate market contracted significantly in the followingmath of the financial crisis. Even at that time, construction companies tried to shake off the unsold units by providing various financial benefits such as discounts on sale prices. At that time, there were over 160,000 unsold houses across the country.

Since then, as the economy has recovered, the unsold pre-sale has been gradually resolved and has fallen to the current level. The price of these apartments has skyrocketed.